by Andre Belelieu*

Over the past two decades, New York City has experienced four different “black swan” or “one in 100 year” events in rapid succession – the terrorist attacks of September 11, the global financial crisis of 2008, Hurricane Sandy in 2012 and most recently the COVID-19 pandemic in early 2020.

New York is by no means an outlier. Globally, the risk landscape has increased substantially as have the frequency and severity with which shocks are occurring. While risk has been a constant feature of human existence, never before in human history have leaders needed to prepare for such a multitude of shocks. Simply put, we have entered an era of not only unprecedented risk, but also unprecedented uncertainty.

One of the key challenges facing business leaders today is how to prepare for this future. No crystal ball is going to emerge that can predict with perfect accuracy what lies ahead, and current risk models will need to be constantly revised as we redefine what is likely. Instead, leaders must adapt their business operations and prepare their workforces for a host of economic, social, geopolitical, technological and health shocks that have the capacity to inflict substantial disruption – increasingly simultaneously – to our businesses, economies and societies.

Enter the new resilience imperative

Following the onset of the COVID-19 pandemic, leaders are understanding that while in the past it may have been possible to be reactive to one specific shock or event, the risk landscape has become more complicated and failing to adopt a more proactive strategy to adapt and mitigate to this landscape is no longer an option.

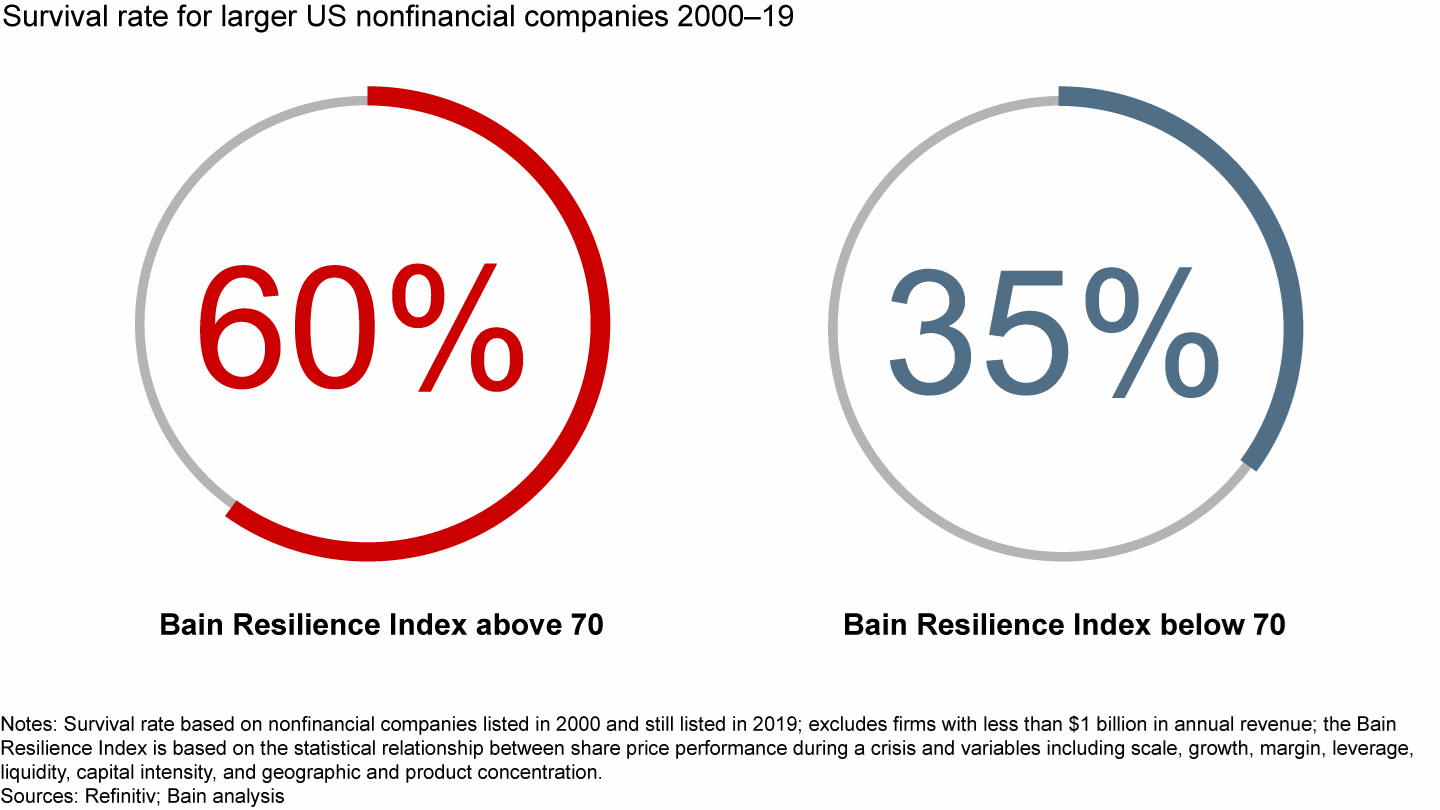

Emerging research is also showing that tomorrow’s winners and losers may be defined by an institution’s investment in their resilience. Bain & Company recently found that firms that placed an emphasis on streamlining operations and improving efficiency had increased profits but at the expense of higher volatility in performance and more business failures. Ultimately, those with higher levels of resilience had a survival rate nearly twice as high as those with lower levels of resilience.

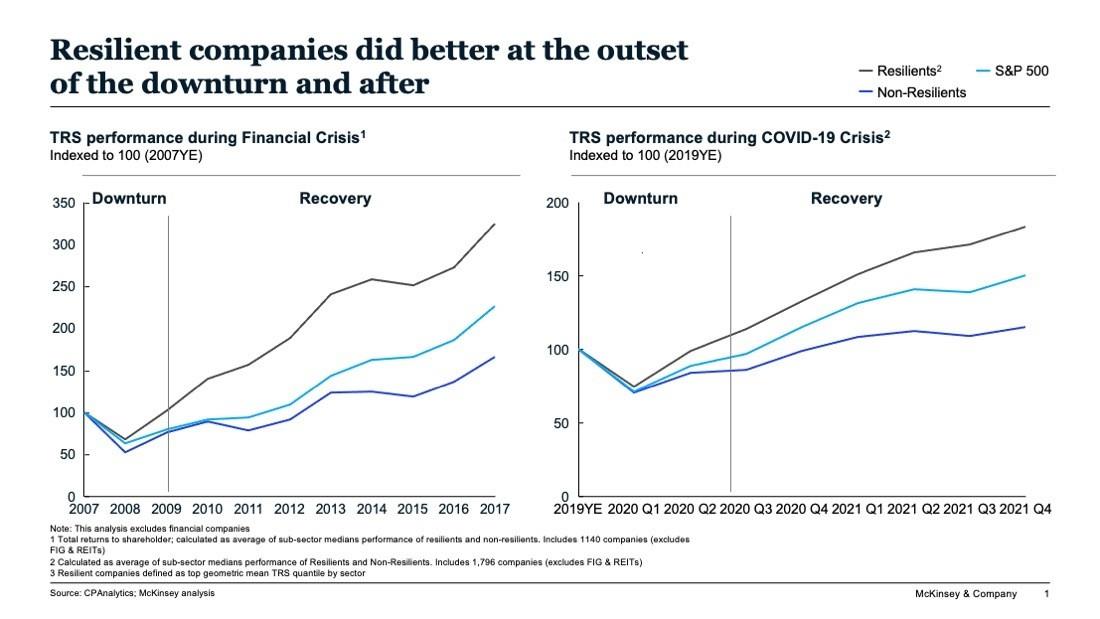

A joint study by McKinsey and the World Economic Forum for the newly launched Resilience Consortium also found that “resilients” outperformed “non-resilients” in shareholder returns during the COVID-19 pandemic, and further estimated that investment in resilience could mean the difference between 1-5% GDP growth per year moving forward.

How can organizations build greater resilience?

Many organizations have become more resilient through their response to the disruptions of the COVID-19 pandemic but some may not know where to start.

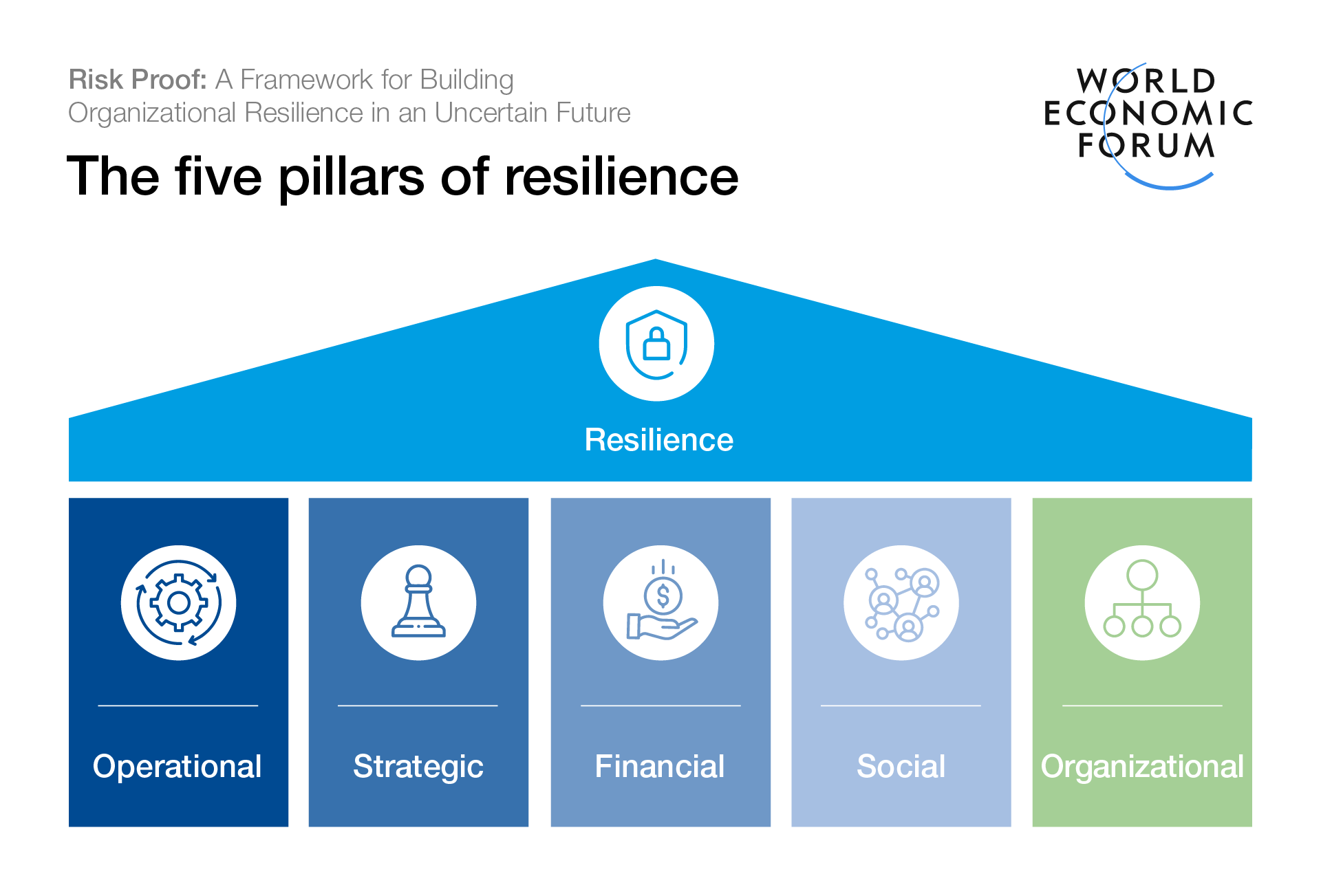

Over the past year, the World Economic Forum has worked with Verisk to produce a framework that can help firms strengthen their organizational resilience. Risk Proof: A Framework for Building Organizational Resilience in an Uncertain Future – aims to offer businesses a framework for greater organizational resilience built on pragmatic and actionable solutions.

The result of over a year of discussions, interviews and workshops within the Forum’s Insurance and Asset Management community, the framework is inspired by three key insights through which organizations can start to anchor or further develop their resilience strategies for the future:

Risk management is not resilience

Many businesses may consider resilience building to be a box they have already ticked with risk management functions focused on identifying, managing and averting risk. Yet resilience building is different from risk management and must live across the entire organization. Resilience is not a response to risk per se (which can often be quantified) but rather to uncertainty (which most often cannot). Building resilience is also about building the mindset and operational philosophy that unlocks and prioritizes the flexibility and agility to be prepared for uncertainty.

Principles not metrics

Our research and discussions were almost unanimous that a resilience score or set of metrics to assess resilience would be not only extremely difficult to build but also the incorrect approach through which to build resilience across organizations that operate in different industries and regions. Anchoring resilience across four key principles rather than hard metrics allows firms from all sectors and regions to design the best fit for them, the societies they operate in and their workforces:

-Resolve is the organization’s will to survive.

-Communication is necessary to move from principled commitment to developing the planning, -goals and procedures that make resilience actionable.

-Agility facilitates execution so that companies can adapt to sudden change.

-Empowerment enables individuals to take ownership and collaborate with peers to meet new challenges.

People and culture are core pillars

While resilience is often associated with supply chains or physical infrastructure, people and culture was identified as the key focus area for any successful organizational resilience strategy in the future. People will have to deliver on the vision and strategy behind any resilience agenda, and company culture will enable the adoption and promotion of the mindset necessary to achieve resilience building goals. Our research also suggests attention to this will only become more critical in the years ahead, particularly as hybrid work models and work from home arrangements become more ubiquitous and continue to modify the ways we collaborate and work together.

Building a resilience framework

Overall, resilience is a critical pillar of future long-term value creation and a business imperative that can no longer be ignored. The lessons learned during the pandemic have deepened the importance of replacing rhetoric and verbal commitments on resilience with tangible action. This framework is an attempt to start building a principles based model that organizations can use to strengthen their resilience. It doesn’t claim to represent a perfect solution and would benefit from further discussion and debate to enrich the framework even further. But we believe it’s a necessary starting point in a world where terms like “black swan” and “one in one hundred year” events are quickly losing their significance.

*Head of Insurance, Asset Management, and Institutional Investors, World Economic Forum

**first published in: www.weforum.org

By: N. Peter Kramer

By: N. Peter Kramer