by Christian Lanng*

COVID-19 revealed that modern supply chains are a house of cards, collapsing the moment they come under any kind of sustained pressure. Many businesses that were caught flat-footed by global lockdowns have found the speed of the recovery just as treacherous to navigate. Clogged ports and widespread shortages have led to record order backlogs across major supply chain hubs.

The crunch on container capacity could last until Q4 2022, according to maritime research firm Drewry. Shortages of key components, including semiconductors, could take even longer to resolve. Is the answer to carry on pushing orders through in the hope that these problems resolve themselves? Two years into the pandemic, there are strong signs global businesses are starting to realize that supply chains actually need root-and-branch reform.

Bursting at the seams

Recent data from Tradeshift suggests buyers are beginning to question the wisdom of putting fresh orders into a system that is coming apart at the seams. Global order volumes fell by 24 points in Q3 2021 (see figure 1), the biggest quarterly drop since the first lockdowns in early 2020 and 15 points below the pre-pandemic forecast range.

Rising invoice volumes provide an indication of how supply chains are reacting to demand signals. Invoice numbers moved five points closer to the expected range in Q3 2021, but the upward trajectory is flatter than anticipated given the significant spike in order volumes during the previous quarter.

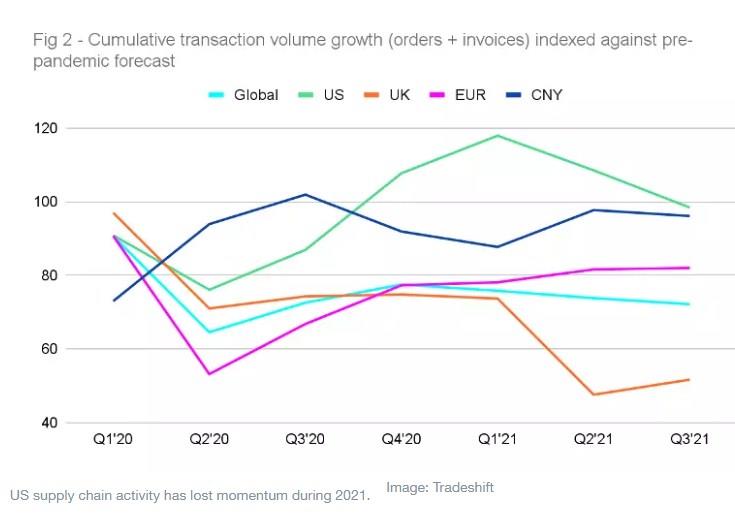

The data suggests it may be some time before order volumes start to align with invoice flows. The longer this gap persists, the more likely it is that the downward trajectory in Q3 signals the beginning of a more prolonged slowdown. The International Monetary Fund recently cut its forecast for US growth by 1 percentage point to 6%, citing supply chain disruption and weakening consumption. Tradeshift’s data indicates that activity across US supply chains, which had been running red-hot since the beginning of 2021, has started to lose momentum more recently (see figure 2).

U.S. transaction volume growth dipped to an index score of 98 against the pre-pandemic forecast range, compared to 108.5 in Q2. In China, the transaction index score fell to 96, a drop of 2 points compared to Q2. Activity across Eurozone supply chains rose a modest 0.5 points in Q3, but an index score of 82 suggests there is some way to go before activity normalizes against the pre-pandemic range. UK supply chain activity moved 4 points closer to pre-pandemic levels in Q3, but this growth is coming from a very low base.

The butterfly effect

It is tempting to blame current supply chain issues on a system that is simply rebooting, meaning these problems will be painful but temporary. Such a narrow view of current challenges ignores deep structural issues in supply chains, however. These issues will cause regular breakdowns in the future if left unchecked.

Lean manufacturing processes have reduced competition to a point where factory closures in one Asian country can unleash global chaos. The antiquated systems that govern relationships across supply chains have led to a butterfly effect, where a lack of agility causes any crisis to spiral into catastrophe. Low connectivity has left businesses blind to potential issues and incapable of reacting in time to avoid a crisis rippling through the value chain.

Creating a global trading system capable of withstanding future shocks will require a coordinated effort from both governments and the private sector. This must involve a mixture of trade reform and investment in industries that have been hollowed out by fragile supply chain models. Such changes will take time and will require significant capital expenditure - but they will also require vision. In this respect, there are signs that things are moving in the right direction.

Towards an agile supply chain

According to a recent study by global consultancy EY, 64% of surveyed supply chain executives say digital transformation will accelerate due to the pandemic. Investment in robotics and semi-autonomous factories are likely to feature heavily in reconfiguration plans. Investment management firm ARK Invest predicts that by 2025 the cost associated with robotics technologies will have fallen 71% compared to 2010.

Beyond the factory floor, organizations are also stepping up their efforts to move past the single-node relationships that had come to define the lean supply chain model pre- pandemic. Research by Cap Gemini shows 68% of organizations are actively investing in diversifying their supplier base. Managing such a transition requires a far more dynamic layer of multi-nodal relationships across a broader supply chain ecosystem. Technologies that enable this kind of flexibility can help alleviate inventory pressures through intelligent pooling of supplier capacity that is matched with areas of significant buyer demand.

The same layer of digital connectivity also underpins innovations in trade financing models that could reduce financial pressure on suppliers during volatile periods. As economies recover, suppliers are now coming under pressure to bear the cost of maintaining excess inventory to help manage demand cycles. Longer payment terms are adding to the squeeze. Large US companies took an average of 58 days to pay suppliers in the first quarter of fiscal 2021, up 5.5% from 55 days in the same period last year, according to research from Hackett Group. A new wave of digitized financing products that can help liquidity flow more quickly to suppliers offers a potential middle ground, enabling buyers to keep cash on hand for longer while incentivizing suppliers to ramp up capacity.

Better together

The current supply chain crisis may be temporary, but volatility could well become a permanent feature of global trade as climate change and other disruptions take hold. Digital transformation is part of the answer, but it’s even more important that we bring about a revolution in the way we think of international trade. We must move away from vulnerable chains where one broken link causes chaos. Instead, we should focus on building a global community of trade: an intertwining network of relationships that supports the agility and end-to-end resilience required to meet future crises with confidence.

*Chief Executive Officer, Chairman and Co-Founder, Tradeshift

**first published in: www.weforum.org

By: N. Peter Kramer

By: N. Peter Kramer