by Eric Sager*

A visit to the grocery store confirms an economic phenomenon that is on the minds of households across the US and just about every investor in the world: inflation is back after a long hiatus.

The latest data shows consumer prices rose in July at the fastest pace in nearly 13 years, which makes it harder for millions of Americans to feed their families and run a household. Inflation also hurts those who lack a bank account or have limited access to financial services, as their cash savings lose value and they pay higher interest when seeking loans.

Hopefully, while inflation won’t reach the double digits of the 1970s and 1980s, it should provide some comfort that our digital economy provides consumers with products that past generations didn’t have. After all, the expansion of fintech makes it easier for consumers to access banking services that can help during inflation, such as savings accounts, loan services and investment tools.

Benefits of digital banking

For consumers making less than $100,000 annually, fintech saves them $360 a year in interest and bank fees, according to research conducted by The Harris Poll. Online banking services such as Dave, Chime, Varo and Go2Bank help by offering low-fee and sometimes no-fee products and early access to wages to avoid potential overdraft charges. Many of the same digital banks provide secured credit cards that carry no interest, no annual fees and require no credit check to apply. This provides another way for consumers to build credit, which can improve access to cheaper loans.

Other fintech companies give customers tools to manage their money when finances get tight. Products such as Truebill and Copilot make it easier to track expenses and lower bills by monitoring subscriptions and other payments. Fintech is also helping people create better financial habits – apps such as Acorns helped pioneer a way to build savings by rounding up transactions and depositing that money into savings accounts. Meanwhile, Flex allows customers to split rent payments into small tranches throughout the month, enabling them to manage their money across paychecks and avoid fees and charges.

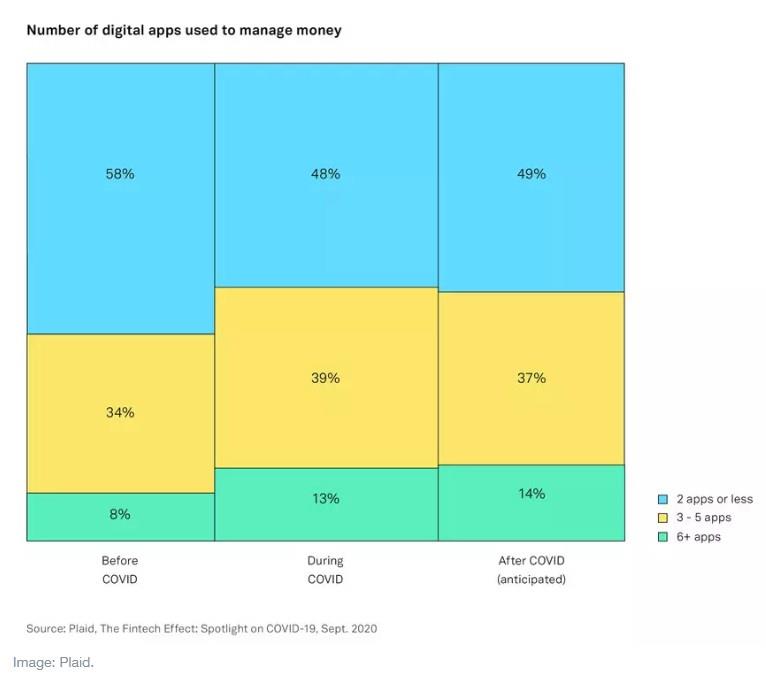

The pandemic increased awareness of these digital services as people opted for online banking and sought out new ways to make ends meet; research shows 59% of Americans are using more fintech apps to manage money than before COVID-19.

Future of the banking industry

The influx of customers is in turn forcing the fintech industry to continue to adapt, improve and expand. Consumer expectations are sky-high as a result of the new and improved options, accelerating the speed of innovation as companies compete to meet these demands. Traditional banks are joining and adding digital services, while embedded finance is allowing non-financial businesses to offer financial services in new ways and at the point of need.

It’s hard to overstate the importance of expanding the reach of a highly competitive banking industry. Even in arguably the most financially developed nation on Earth, one in five Americans is unbanked or lacks access to competitive banking services, which makes them vulnerable to excessive fees. In fact, consumers living paycheck to paycheck paid out $17 billion in overdraft fees to major banks in 2019, according to a report by Oliver Wyman.

The problem came to the forefront during the early days of COVID-19, when many minority-owned businesses without established relationships with bigger banks found it harder to access government funding in the Paycheck Protection Program. Fintech companies succeeded in addressing this problem head-on because they are fast to adapt and have no geographic boundaries. Minority entrepreneurs were able to log on and connect to sources of capital that were once denied them. According to a study by researchers at New York University, fintechs made more than 845,000 loans under PPP last year, with a “substantially larger” share of them going to African American owned businesses than the traditional lenders.

As fintech expands, this more connected and digital financial landscape will give customers new experiences with minimal onboarding, lowering the barrier for developers and companies to push new, highly-customized innovations to meet the shifting needs of all people. This transformation to digital will also bring even greater inclusiveness and lower costs for the traditionally underserved. From a provider’s perspective, it will become less expensive and less risky to serve broader demographics.

Just as they did during the early days of PPP in 2020, fintechs, as well as banks and companies embracing embedded finance, must further adapt and help the most vulnerable if faster inflation or other economic shocks take hold. They can help address the number of unbanked in the country, empowering people in a way that softens the blow of consumer price increases, as they bank from their phones or even library computers.

The next few years will undoubtedly see other radical transformations across our industry that we can’t quite envision yet, and it’s no exaggeration to say a fully digital financial system is possible within the next decade. That means the financial world people want and need will finally be at our fingertips.

*Chief Operating Officer, Plaid

**first published in: www.weforum.org

By: N. Peter Kramer

By: N. Peter Kramer