by Florence Jaumotte and Gregor Schwerhoff*

Climate action is gaining momentum. Since the 2015 Paris Agreement, countries have intensified climate action and many have committed to reach net zero emissions by 2050, meaning that any additional carbon emissions will be offset completely by carbon emissions withdrawn from the atmosphere.

However, the carbon budget, or maximum amount of emissions allowable, to limit global warming to well below 2°C is running out quickly. More frequent and intense disasters, a decline in agricultural productivity, and rising sea levels will only grow more common if this critical goal is not met.

In our recent G20 Background Note on climate policy, we detail the policies and, crucially, the amount of investment needed over the next 5 to 10 years to reach net zero emissions by 2050 in a growth-friendly manner. The strategy has three building blocks: carbon pricing; a green investment plan; and measures for a just transition.

Carbon price: Carbon pricing, which can take the form of a carbon tax or emissions trading schemes (or equivalent measures such as sector-level regulations), are key elements of the decarbonization strategy. Green investment and R&D support are unlikely to be enough to reach net zero emissions by mid-century. By raising the cost of high-carbon energy, carbon pricing incentivizes a shift to cleaner fuels and energy efficiency. By contrast, only increasing the supply of clean energy sources tends to lower the cost of energy and does not incentivize energy efficiency as much, making it harder to reach net-zero emissions targets.

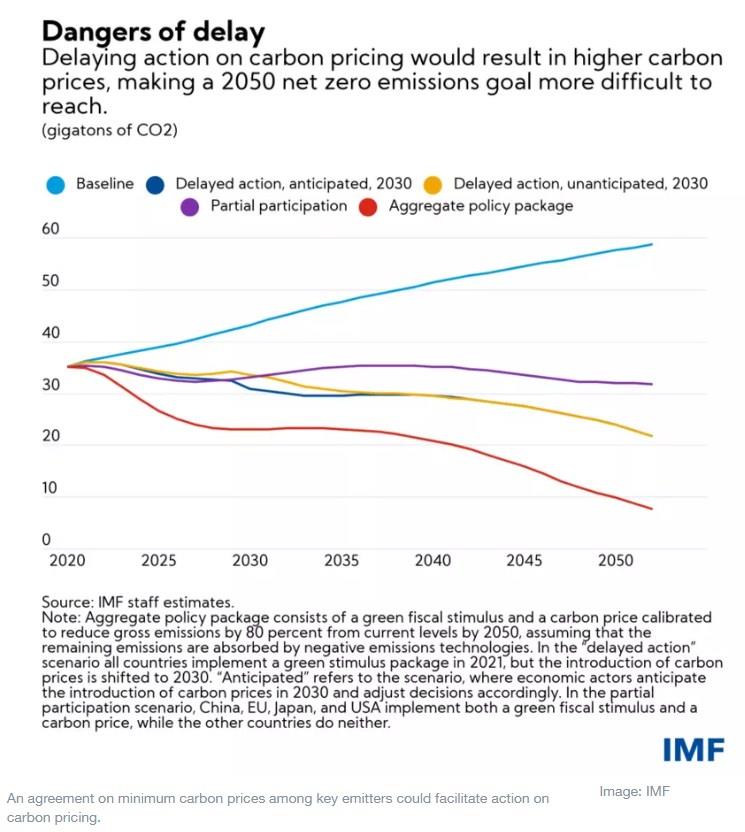

Our analysis shows that delaying action on carbon pricing by 10 years would likely result in missing a mid-century net zero emission target by a large margin, since the prices required at that point to reach those goals would appear unviable. Such a delay, compared with the swift introduction of carbon pricing, would raise temperatures and result in potential irreversible damage to the climate and the economy. An agreement on minimum carbon prices among key emitters, with differentiated prices according to level of development, as recently proposed by IMF staff , could facilitate action on carbon pricing by addressing concerns that unilateral action could lead to competitiveness losses for firms in energy-intensive and trade-exposed sectors and shift production to countries with lower prices.

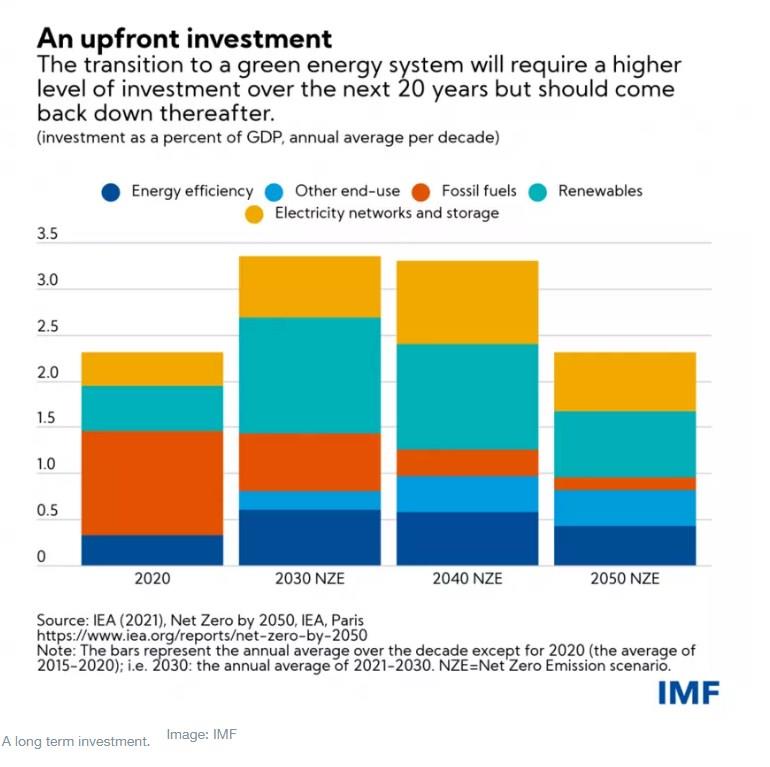

Green investment: Green investments are crucial to enable the transition to a low-carbon economy and support the response to carbon pricing. Radically transforming our energy system will require investments to be scaled up to finance the shift from fossil fuels to renewables as well for smart electricity networks, energy efficiency measures, and electrification in sectors like transport, buildings, and industry. Large investments will be needed in the transition. For example, a person looking to buy a new car may be more willing to purchase a battery-powered vehicle rather than one that runs on gasoline if electric vehicle charging stations are more widely available. Investing in R&D is also key—further technological progress in low-carbon technologies will be needed to make the transition to net zero feasible.

In many sectors, while reducing emissions can come with a higher upfront investment associated with building new infrastructure, it brings a lower recurrent cost due to a reduction in fuel consumption. Installing solar panels to power a water pump for a rural village involves a new cost initially—for example—but the sun’s energy is free. Investments to improve energy efficiency follow a similar path. As a result, the investment is hump-shaped, with an increase in the next 20 years and a decrease to recent historical levels after that.

An estimated additional $6 to 10 trillion in global investments, both public and private, are needed in the next decade to mitigate climate change. This amounts to a cumulative 6-10 percent of annual global GDP.

According to International Energy Agency data, about 30 percent of additional investment, on average globally, is expected to come from public sources—that is a cumulative 2-3 percent of annual GDP for the decade 2021 to 2030. The remaining 70 percent would be private.

On the public side, fiscal packages from governments to support recovery from the COVID-19 pandemic are a unique opportunity to invest in a transition to a low-carbon economy. And as we move beyond recovery, governments should also move toward a more comprehensive system of green budgeting, examining both “brown” and “green” incentives budgets are offering and helping align budgets with nationally determined contributions (NDCs) and the Paris Agreement goals.

Governments can also help mobilize capital from the private sector by improving investment frameworks, helping create pipelines of bankable projects, and using international public financing effectively to reduce perceived risks and bring down the high cost of capital (the latter, especially in emerging and developing economies). Financial sector policies such as requiring disclosures of climate-related risks and establishing a common taxonomy of what constitutes green and brown assets would also be crucial to channel financial flows into sustainable investments.

Just transition: A just transition takes both a domestic and an international dimension. On the domestic side, governments need measures to help households already struggling to afford basic necessities pay for higher energy costs. These measures should extend to coal miners and other workers and communities that depend on high carbon sectors for their livelihoods. On the international front, financial support will be necessary for developing economies, which are expected to incur greater costs in the transition yet have little means to pay for it.

Major carbon emitters like China, the EU, Japan, Korea, and the US have made pledges to reach net zero emissions by mid-century. This will reduce a large share of global emissions but also provide technology and policy solutions to make it easier and more affordable for other countries to follow. Still, without a global climate policy, today’s smaller emitters will become major emitters as their populations and incomes grow. These are also the countries, often harder hit by the effects of climate change, for which the transition costs are more difficult to bear, due to fast-growing energy needs and less budgetary space to finance green investments.

Climate finance—financing emission-reducing investments in developing economies—would allow for a more even burden-sharing and help the global economy reach net zero emissions. Many developing economies are prepared to ramp up their NDCs if they receive climate finance, and given that many of the world’s lowest-cost mitigation opportunities exist in emerging and developing economies, it is in the global interest to make sure that these are pursued.

*Senior Economist, Research Department, IMF and Economist, Multilateral Surveillance Division of the IMF’s Research Department

**first published in: www.weforum.org

By: N. Peter Kramer

By: N. Peter Kramer