by Theo Vermaelen*

Some industries are connected in myriad ways to other industries, and financial analysts manage to turn those connections into breadcrumbs to follow along information trails. By looking at how suppliers or customers from other industries are faring, an analyst can make an informed prediction about upcoming earnings announcements. The more connections to other industries a firm has, the more network centrality it has. Firms without many connections to other industries, like software companies that create cloud-based systems, tend to stay within the same industry so they have low network centrality. Because wholesale trade is reliant on many suppliers, customers and transport links, it has a high network centrality.

Consider the ripple effects of the oil industry. If those firms supply an excess of gasoline, oil prices go down. Then firms in the transportation industry, like FedEx, have lower costs which could lead to retail firms increasing their bottom line. Analysts study the ripple effects of this information flow to better value downstream or upstream firms.

Co-authored with Theodoros Evgeniou, Joel Peress and Ling Yue, our paper “Network Centrality and Managerial Market Timing Ability” is forthcoming in the Journal of Financial and Quantitative Analysis. Yue’s dissertation on network centrality inspired us to look at the link between share buybacks and network centrality.

When a company buys back its stock, it is generally because managers believe their stock is undervalued. They believe they have superior information than the markets, in particular that of analysts who are supposed to make markets efficient. In this paper, we ask: When does a manager have a competitive information advantage over these experts?

The importance of links in predicting long-term excess returns

In my past research, I have shown that other indicators can explain long-term excess returns after buyback announcements. Buybacks by small cap firms are followed by higher excess returns because small firms are less likely to be followed by analysts. The same conclusion holds for firms with higher company-specific volatility as they are more likely driven by company-specific information. Also, simple valuation metrics such as market-to-book ratios and stock price declines prior to the buyback announcement predict long-term excess returns. Is network centrality another predictor after controlling for these indicators?

In this paper, we consider two types of information. The first, which we call non-link related, is unrelated to links between a firm and other industries; for example, an in-house innovation that is not yet publicly known. Managers get this information as part of their job; they don’t have to “invest” to get this information.

Link-related information, on the other hand, involves external customers, firms and industries. Obtaining this information requires investment and here analysts have a competitive advantage. When the number of links is small, this competitive advantage is low, so non-link “inside” information dominates. When the number of links becomes larger, the value of non-link related information becomes less dominant, so insiders lose their competitive advantage.

However, when the number of links increases by a large degree, it becomes too costly for analysts to incorporate all the link-related information and again, as in companies with few links, inside (non-link related) information dominates. So, our model predicts a U-shaped relationship between long-term excess returns and network centrality.

We test our model using data from more than 8,000 buyback announcements from October 2006 to December 2015. Consistent with the model, buybacks by firms with very low network centrality and very high network centrality are followed by very large four-year excess returns of 26 percent and 21 percent, respectively. Buybacks made by firms with average network centrality are followed by much smaller excess returns of 10 percent after four years.

Combining with past research to obtain the optimal trading strategy

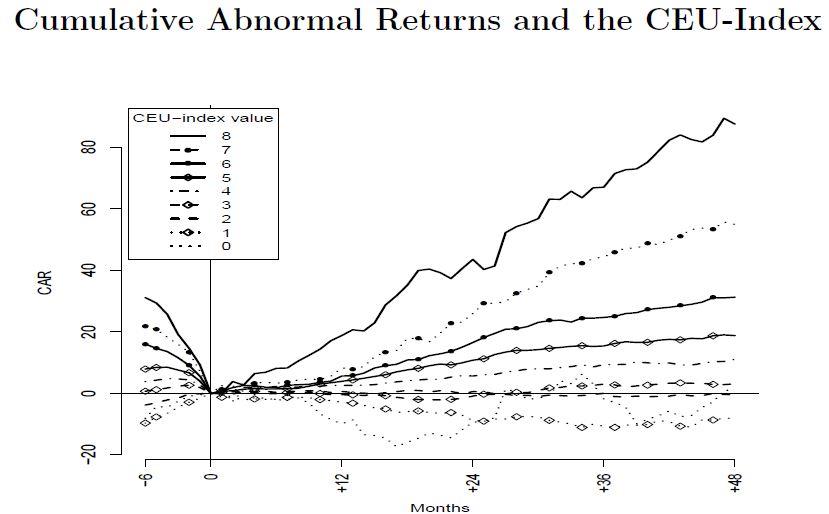

In previous research, we showed how we can use other variables to predict long-term excess returns, such as market-to-book, firm size, prior return and company-specific volatility. We combine these variables with our measure of centrality into what we call the Centrality Enhanced Undervaluation (CEU) index. The index ranges from 0 to 8. A value of 8 corresponds to buybacks done by small, beaten-up value stocks with high company-specific volatility and either very high or very low centrality. A value of 0 corresponds to buybacks made by large growth firms with low company-specific volatility and median levels of centrality. The figure below shows the risk-adjusted four-year excess returns an investor could have obtained by investing in buyback firms with different levels of the CEU index. For example, investing in the top CEU-index stocks would have generated excess returns of more than 80 percent. The lower the CEU index, the lower the returns with basically zero excess returns in the very low CEU-index stocks.

Why does the buyback anomaly persist?

One of the puzzles in finance is that for the last 30 years, markets have not become more efficient in relation to share buybacks. People are largely sceptical about buybacks. Perhaps because they have an inherent mistrust in managers. Those who allege that buybacks are only about short-term stock manipulation must believe that managers are either liars or not very smart. Also, in many cases, the company buys back after the stock missed earnings forecasts. Then the analysts downgrade these firms, so a buyback is an implicit criticism of the analyst community. And other research shows that trading against analyst recommendations is not a smart strategy.

Moreover, our strategy works in the long run, and only on average, so it requires investing in a diversified portfolio of buyback stocks with the right characteristics (summarised by the CEU index), and hanging in there, without getting distracted by short-term volatility.

*Professor of Finance at INSEAD and the UBS Chair in Investment Banking, endowed in honour of Henry Grunfeld and chair of the Finance academic area and programme director of Advanced International Corporate Finance, an INSEAD Executive Education programme

**first published in: knowledge.insead.edu

By: N. Peter Kramer

By: N. Peter Kramer