by Filip Ac and Paulina Mozolewska and Vasiliki Angouridi

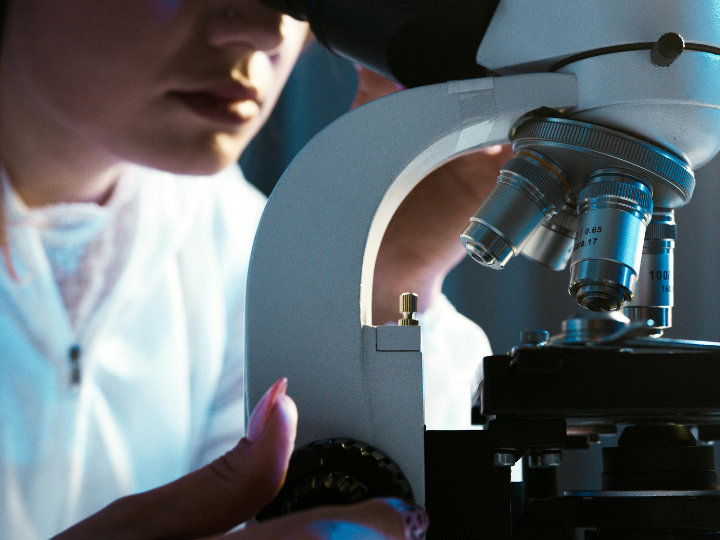

Despite a global surge in clinical trials over the past decade, Europe’s role in advancing new medical treatments is waning. As the EU struggles to regain competitiveness, fragmentation is dragging the sector.

A report on clinical trials conducted by IQVIA for EFPIA and Vaccines Europe shows significant country-level variation within the EEA. Even those who register some rise in percentages, like Greece and Slovakia, still face obstacles that restrain meaningful growth.

According to the report, the European Economic Area (EEA) now accounts for just 12% of worldwide commercial trials - those sponsored by a pharmaceutical company - down from 22% in 2013. This decline means that 60,000 fewer European patients participated in a clinical trial.

“European clinical trials are hampered by a slow and fragmented research ecosystem, and current initiatives, at the current pace, are insufficient to stop and reverse a decade of decline,” Nathalie Moll, Director General of EFPIA, said in the press release.

To increase Europeans’ opportunities to access medical breakthroughs and for Europe to be competitive, “It needs to function as a unified region, not as individual Member States and be supported by policies to attract global research investment,” she added.

Greece needs an improved incentive system

The report shows that all but three EEA countries registered a fall in the absolute number of trials starting in 2023 compared to 2018. Greece had 105 commercial clinical trials starting in 2018 and recorded a steady rise to 151 in 2022, but the number fell to 106 in 2023.

“There is a lag in the number of clinical trials in Greece compared to other European countries,” Mihalis Himonas, SFEE’s General Manager, told Euractiv.

According to SFEE, the Hellenic Association of Pharmaceutical Companies, over €44 billion is invested annually in R&D in Europe, with Greece attracting only about €100 million of that.

Clinical trials benefit both patients and the healthcare system. Patients have free access to innovative therapies, while the healthcare system benefits from savings.

“For example, for every cancer patient participating in a clinical trial, the healthcare system has savings of €70,000 annually,” said SFEE’s General Manager.

Referencing the so-called ‘investment clawback,’ Himonas remarked: “SFEE’s proposal was, and remains, to improve the existing incentive framework for clinical trials in order to make it work more efficiently, as has been the case with productive investments in factories,”

’Investment clawback’ is an industry term used to describe the offset of mandatory returns with corresponding investments in areas of production expenditure and research and development (R&D) under the Recovery and Resilience Fund (RRF) framework, which has not proved as attractive for clinical trials.

Under the RRF, more than 95% of the 2022-2023 funds were absorbed by productive investments, and only €10 million of the €250 million total were absorbed by clinical trials.

Before the measure was included in the RRF programme, €50 million per year was absorbed for 2020-2021.

Himonas also outlined the need for a stable, predictable, transparent environment, with reduced over-taxation and bureaucracy, to attract investment.

A study conducted by SFEE in collaboration with PwC underlined the need for a national strategic plan to facilitate patient participation, simplify procedures, reduce bureaucracy, improve approval times, provide incentives for research and development, and promote the training of hospital administrative staff.

“In a moderate scenario, that is, if we manage to reach the European average based on the size of our country, we can attract an initial investment - over a three-year period - of €400-500 million per year. In this way, we can achieve GDP growth and create thousands of new jobs,” Himonas explained.

Developing a broader incentive framework to attract more clinical trials is a common goal all stakeholders, including the Ministry of Health, agreed upon, according to SFEE.

Prioritise implementation in Slovakia

Portugal and Slovakia are the other two countries showing slight improvement, with a 0.7% and 1.2% increase, respectively.

However, as the executive director of AIFP, the Slovak Association of Innovative Pharmaceutical Industry, Iveta Palesova, explained, the number of trials and patients included have been dropping.

"The conditions for conducting clinical trials in our country are in place, as evidenced by the fact that they are still ongoing. According to a survey of member companies of the AIFP), these companies invested over 31 million euros in clinical trials in 2023 across 164 trials, allowing 4,895 patients to benefit from the latest therapies,” she said in a statement to Euractiv.

She explained, “If we compare the data from the same survey in previous years (excluding the COVID-19 period), we see that the number of clinical trials and treated patients has been systematically decreasing.”

However, it is not a downward trend limited to Slovakia, as Palesova said, pointing to the

The EFPIA/IQVIA/Vaccines Europe report shows that the number of European trials has significantly decreased over the past 10 years.

“Although Slovakia, as one of the few EU countries, recorded positive numbers in terms of studies per capita and CAGR between 2018 and 2023, it is now starting to fall considerably behind other CEE countries in terms of absolute numbers," she added.

"With the implementation of the EU regulation, the country’s legislation has been harmonised to the EU level, aiming to ensure uniform approval of new clinical trials across all participating member states,” Palesova explained.

She estimates that even though “The European information system for clinical trials was launched in 2022, its functionality will not benefit patients unless conditions for conducting clinical trials improve directly here in Slovakia and their implementation becomes a priority within Slovak healthcare.”

“The establishment of a permanent advisory body for clinical trials within the Ministry of Health offers hope and a means to achieve this goal. This body could contribute to unifying the regulatory environment for clinical trials, as well as bring about further administrative improvements," she said.

Poland has something to aim for

“If the number of clinical trials is rapidly increasing worldwide but declining in Europe by as much as 12%, this is a clear sign that we are becoming less competitive in this field, necessitating decisions and actions to reverse this trend,” Michal Byliniak, Director-General of The Employers’ Union of Innovative Pharmaceutical Companies (INFARMA) told Euractiv.

He said, “In Poland, this decline was among the lowest, at just 2%, and in oncology trials, Poland, Spain, and Denmark demonstrate the fastest trial initiation times and rapid recruitment rates.”

“However, this doesn’t mean we can rest easy,” Byliniak explained, adding that “Poland’s potential is far greater, and if we begin to see clinical trials as an integral part of the healthcare system, the country has significant scope to increase the volume of clinical trials.”

According to Byliniak, this is evidenced by Poland’s rate of commercial clinical trials per capita, which is currently at 0.82, “while in some countries, it’s twice as high, giving us something to aim for.”

“This is not only important for the economy and medical advancement but most importantly for patients who are losing access to the latest therapies, often therapies of last resort,” he added.

*first published in: Euractiv.com

By: N. Peter Kramer

By: N. Peter Kramer