But Ben Bernanke stopped short of saying an official inquiry was under way by either the Fed or the regulator.

Goldman Sachs was the only firm which Mr Bernanke mentioned by name. Earlier this week a Goldman Sachs boss defended the bank's 2001 debt-swap deal with Greece that may have allowed the country to mask the extent of its debt problems.

Gerald Corrigan, chairman of Goldman Sachs Bank USA, the bank's holding company, said it was "consistent" with the regulations of the time. However, speaking in the UK to the Treasury Select Committee, he admitted that "with hindsight" it should have been more transparent. The debt-swap deal was legal at the time, but has since been prohibited.

Economy analysis

The complicated "currency swap" financial deal between Greece and Goldman Sachs is already being investigated by the European Union (EU) after it was discovered by the EU statistics agency Eurostat. It is claimed that the deal enabled Greece to hide the extent of both its public deficit and national debt. The EU has given Greece until the end of February to give details of how it affected its accounts.

Greece's Finance Minister George Papaconstantinou also insisted last week that his country was not the only one using such financial arrangements back in 2001. Following the financial crisis, Goldman and other Wall Street firms converted from investment banks to bank holding companies. This allowed them to access government bail-out money but also put supervision of them more firmly in the Fed's hands.

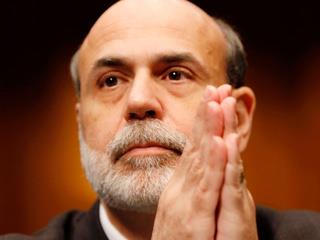

"We are looking into a number of questions related to Goldman Sachs and other companies in their derivatives arrangements with Greece," Mr Bernanke said in response to a question from US Senate banking committee chairman Christopher Dodd. The Fed boss was testifying for a second day on the state of the US economy. Last Wednesday he had said interest rates would remain at record lows "for an extended period", adding there was a "nascent economic recovery".

By: N. Peter Kramer

By: N. Peter Kramer