by Renee van Heusden and Adele Jacquard*

The invasion of Ukraine created ripples through the global energy market, particularly in the European Union (EU), which had to pivot quickly to secure enough gas for winter 2022/23.

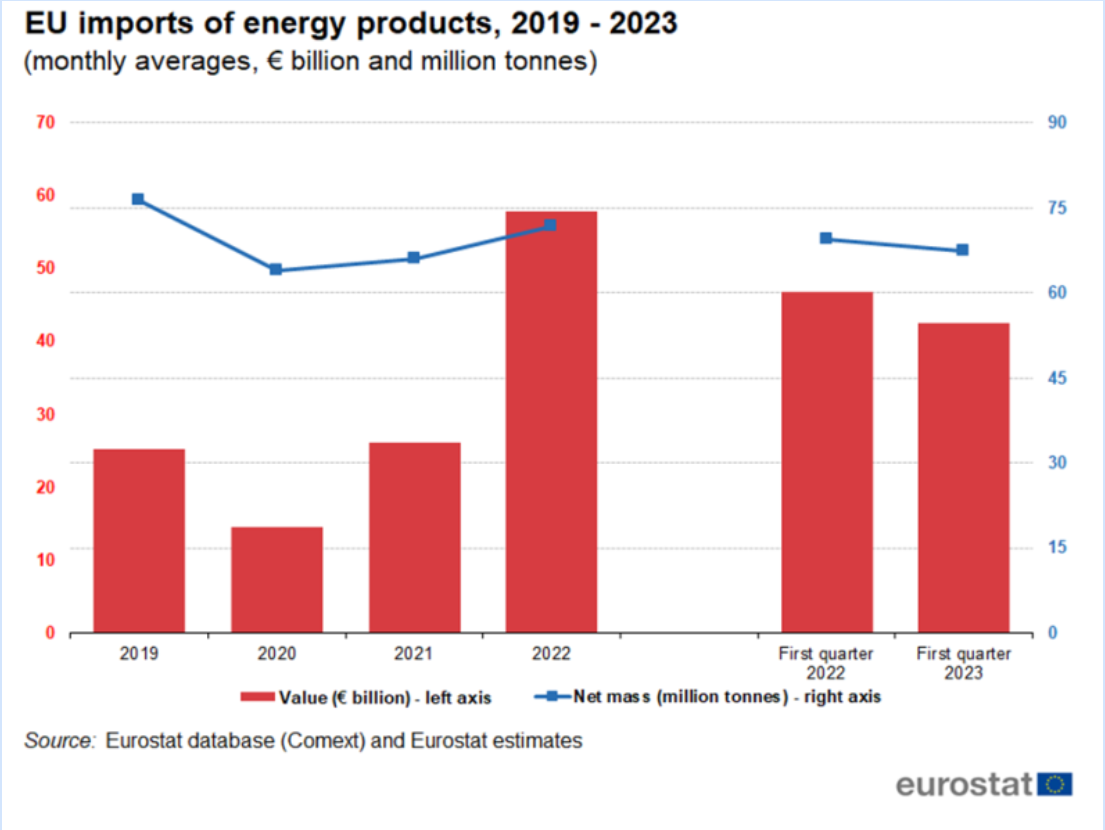

But it paid the price. Europe spent over €1 trillion more on oil, gas, and coal in 2022 than the previous year, more than doubling the share of its GDP spent on energy.

More recently, reports of Europe having “too much gas” show how markedly the situation has shifted for the EU.

The story of the EU’s gas shortage is ongoing, but the major disruptions the region experienced at the beginning of the crisis subsided more quickly than feared. However, as the IEA reported recently, the tables can turn again quickly – so what has changed since 2022, and is the EU ready for winter 2023/24?

Europe’s tumultuous year for energy supply

Europe’s energy crisis started with Russia’s invasion of Ukraine on 24 February 2022. The rest of the year saw export controls, investment bans and price cap initiatives taken by the United States, the EU and the United Kingdom to deter the continuation and escalation of conflict.

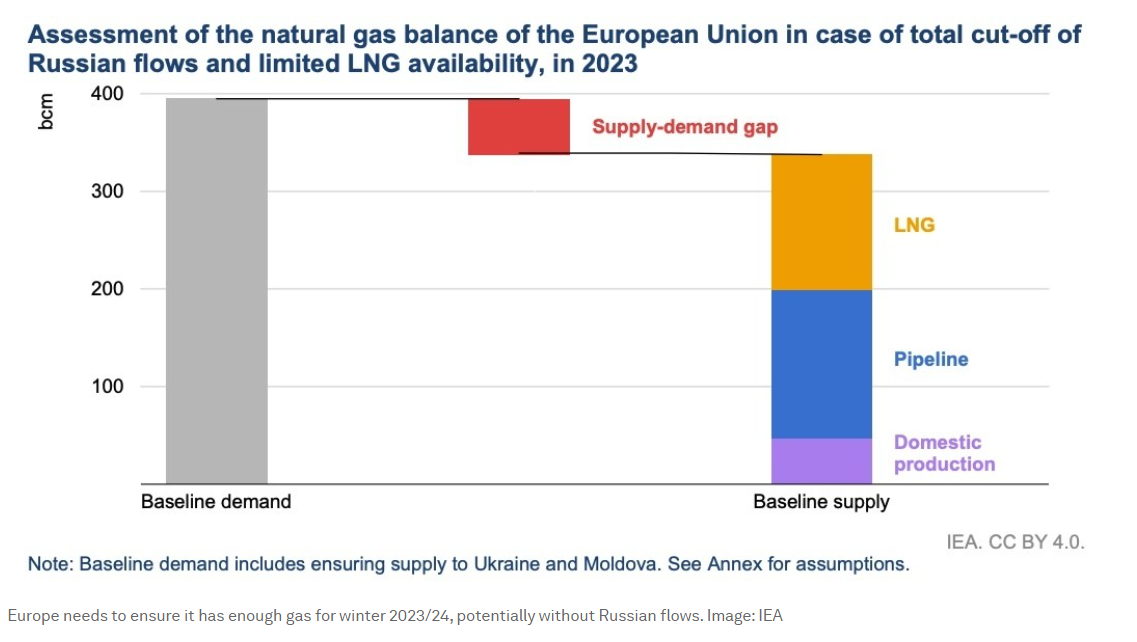

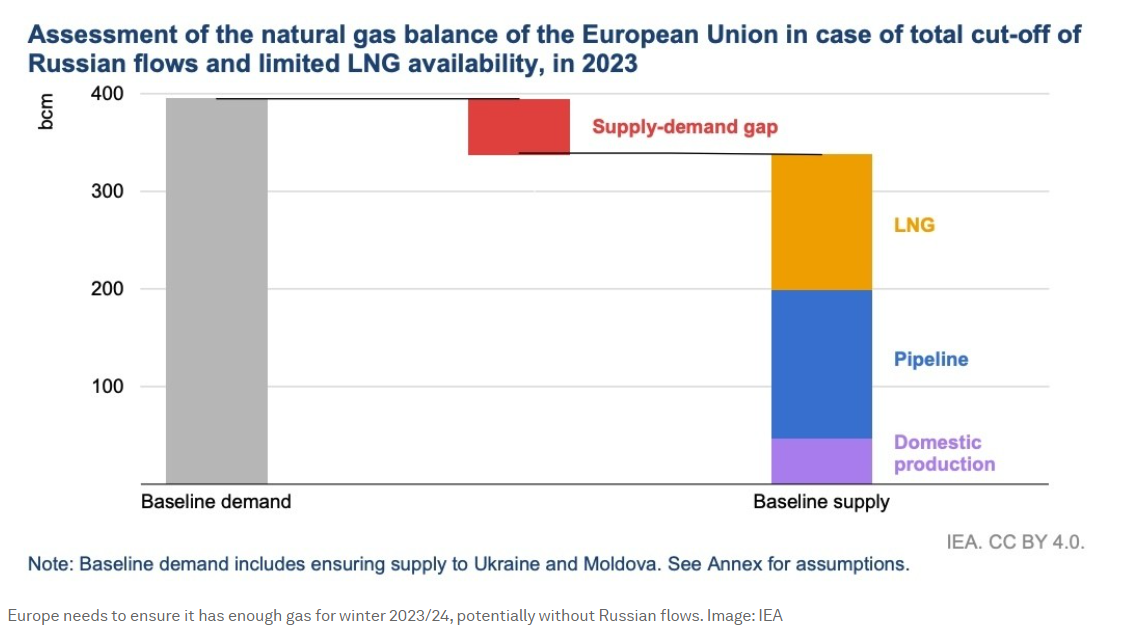

Russia retaliated by introducing sanctions, which led to a tightening of the global gas market, particularly in Europe, where Russia previously supplied around 40% of the region’s natural gas.

In response to the price caps, Russia prohibited the export of oil and oil products under contracts with price cap compliance provisions. And when several EU member states refused to adhere to the new payment system imposed by Russia in the second quarter of 2022, Russia’s state-controlled energy firm Gazprom unilaterally cut a substantial part of its gas supplies.

All in all, the sanctions, combined with various economic countermeasures and the sabotage of Nord Stream 2 – a gas pipeline running from Russia through Germany – led to tight supply in the gas market, particularly in Europe. This led to drastic energy price increases.

Last year, gas prices peaked at $100 per million metric British thermal units (MMBtu), Brent crude oil prices reached $130 per barrel, and coal prices peaked at $441 per ton. Energy needs were ultimately met, but the costs were high, especially in terms of energy equity — meaning both affordability and access — a key insight from the World Economic Forum’s recent analysis and report on Energy Transition Index 2023.

Europe’s gas strategy heading into winter 2023/24

The International Energy Agency’s (IEA) How to Avoid Gas Shortages in the EU in 2023 report also contains a series of suggested initiatives to balance short-term needs with the long-term energy transition strategy.

In the short term, Europe needs to ensure it has enough gas storage to get through the winter, limit its reliance on Russian gas, and maintain or lower gas demand. It has rolled out several initiatives to achieve it.

The introduction of minimum gas storage obligations targets at least 90% of capacity for winter 2023/24 and onwards – to bolster the EU’s energy security and achieve a more optimal storage cycle throughout the year.

Policies also targeted the liquified natural gas (LNG) market and included LNG procurement mechanisms based on increasing coordination and storage to reduce price volatility.

Meanwhile, the EU Council introduced the Joint Purchasing Mechanism, which allows for joint purchasing and more efficient ways of matching demand with suppliers, including for countries outside the EU.

And lastly, the bloc has been diversifying its energy base, growing the baseline of renewables, critical for a secure and economic energy system as it reduces dependency, enhances resilience and manages economic risks.

So far, the initiatives have been successful. As of July 4th, Europe’s gas storage was at 79%.

At the current pace of refilling, storage is expected to hit its target capacity before October, Reuters reported based on data from Gas Infrastructure Europe. The abundance of European gas storage and the fast pace of refilling has caused prices to fall sharply in the first half of the year.

The impact of quick and decisive action by the EU to mitigate the effects of the energy crisis has provided room for some optimism heading into winter 2023/34.

But the bloc must also remain focussed on its long-term goals in the coming months, especially as the south of Europe is currently battling severe heatwaves.

Implications for the energy transition

The latest Fostering Effective Energy Transition Report says that the actions we take in the next few years are critical to the success of our long-term energy goals.

We are all in the energy transition together, and actions taken in Europe have ramifications across the globe. Europe’s surging demand for gas has already impacted lower-income regions and the pace of their transition: high global LNG prices have outpriced regions such as southeast Asia and driven some countries back towards coal dependence. The continued unaffordability of cleaner energy sources like gas and LNG could push more lower income economies to switch back to coal, slowing the global pace of the transition.

The EU has come a long way from the frenzied stockpiling that drove up gas prices a year ago, but the energy crisis is far from over. Europe must now prioritise its own energy requirements heading into winter 2023/24 by focusing on energy security and reducing unilateral reliance.

Policies and interventions that kept energy demand in the EU down should remain in place to stem a demand surge when the energy crisis concludes.

Europe’s energy crisis has already accelerated its transition, bolstered the region’s security, and forced it to reduce consumption. But this period of upheaval is also an opportunity to build on that progress and continue the drive for a more diversified and resilient energy system.

*Head, Oil & Gas Industry, World Economic Forum and Oil and Gas Transition Researcher, World Economic Forum

**first published in: Weforum.org

By: N. Peter Kramer

By: N. Peter Kramer