by Muqsit Ashraf and Roberto Bocca*

An industrial-scale problem…

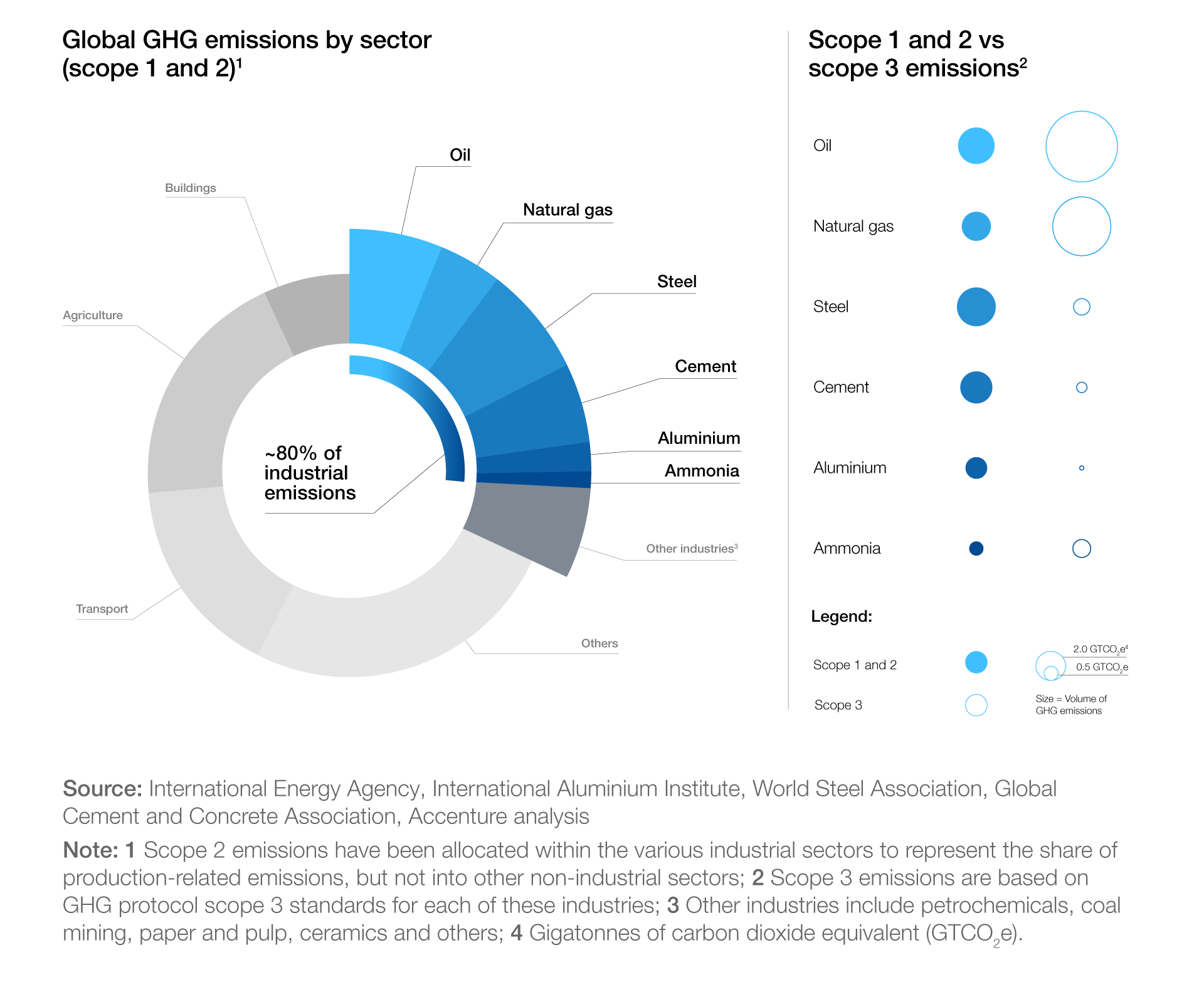

Today, industrial sectors account for nearly 40% of global energy consumption and more than 30% of global greenhouse gas emissions. The five industries of steel, cement, aluminium, ammonia as well as oil and gas generate approximately 80% of these emissions. Demand for energy and industrial products is forecasted to increase by further 30% to 80% by 2050. If the decarbonisation of industries does not radically pick up pace, industrial emissions will only rise with demand. This would mean the world’s ambition to achieve net zero can be pushed further out of reach.

… Requires an industrial-grade solution

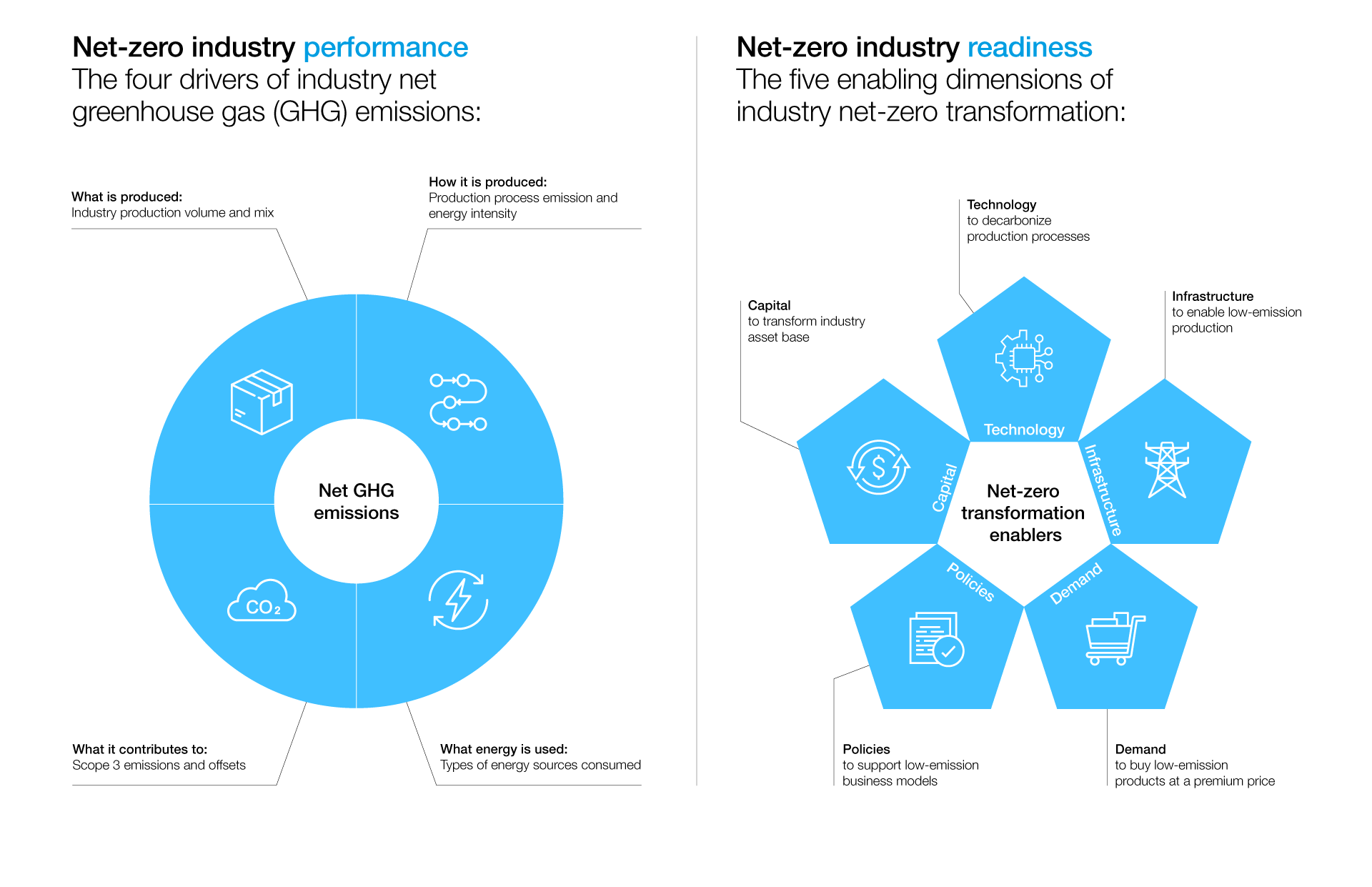

There will be no net-zero future if industries don’t decarbonise. It is imperative to understand the scope of the challenge, the variety of opportunities for industry sectors, and to comprehensively and consistently track the progress on industrial decarbonization.

For this purpose, the World Economic Forum recently launched the Net-Zero Industry Tracker to raise transparency and accelerate industrial transformation. This initiative offers a comprehensive framework for monitoring industries’ progress towards net zero. On top of that, it provides insights to inform industry leaders, policymakers and consumers about actions that are the most critical and most effective.

5 actions for 5 industries

Based on insights from the Tracker’s inaugural report, here are five recommendations for stakeholders of the five industries that produce the most industrial emissions:

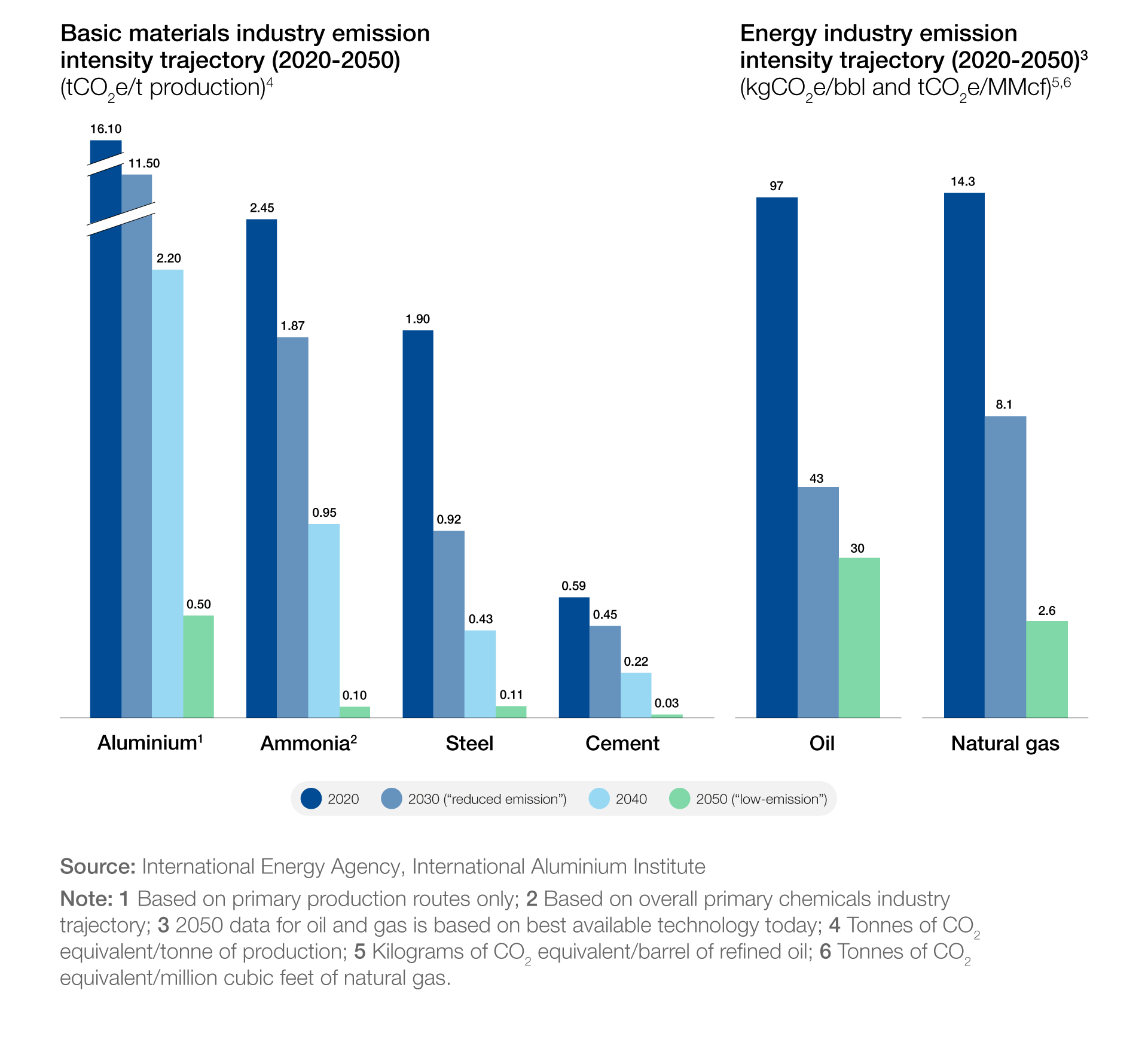

1. Define “low-emission” production thresholds to direct decarbonization trajectories

Net-zero targets are necessary to set long-term ambitions, but they are insufficient to drive year-over-year progress. For basic materials as well as oil and gas, international sustainability standards need to establish emission intensity thresholds that anchor what “low-emission” production in a net-zero world looks like. These thresholds should be technology agnostic and account for varying product specifications, such as clinker ratio in cement or scrap content in aluminium or steel. Industry standards such as the Aluminium Stewardship Initiative or Responsible Steel alongside multi-stakeholder collaboration (such as the IEA’s recommendations for achieving net zero heavy industry sectors in G7 members) will be essential to define thresholds within each sector.

At present, across all five industries, the gap to meet the 2050 emission thresholds outlined in the IEA Net Zero by 2050 Scenario is considerable.

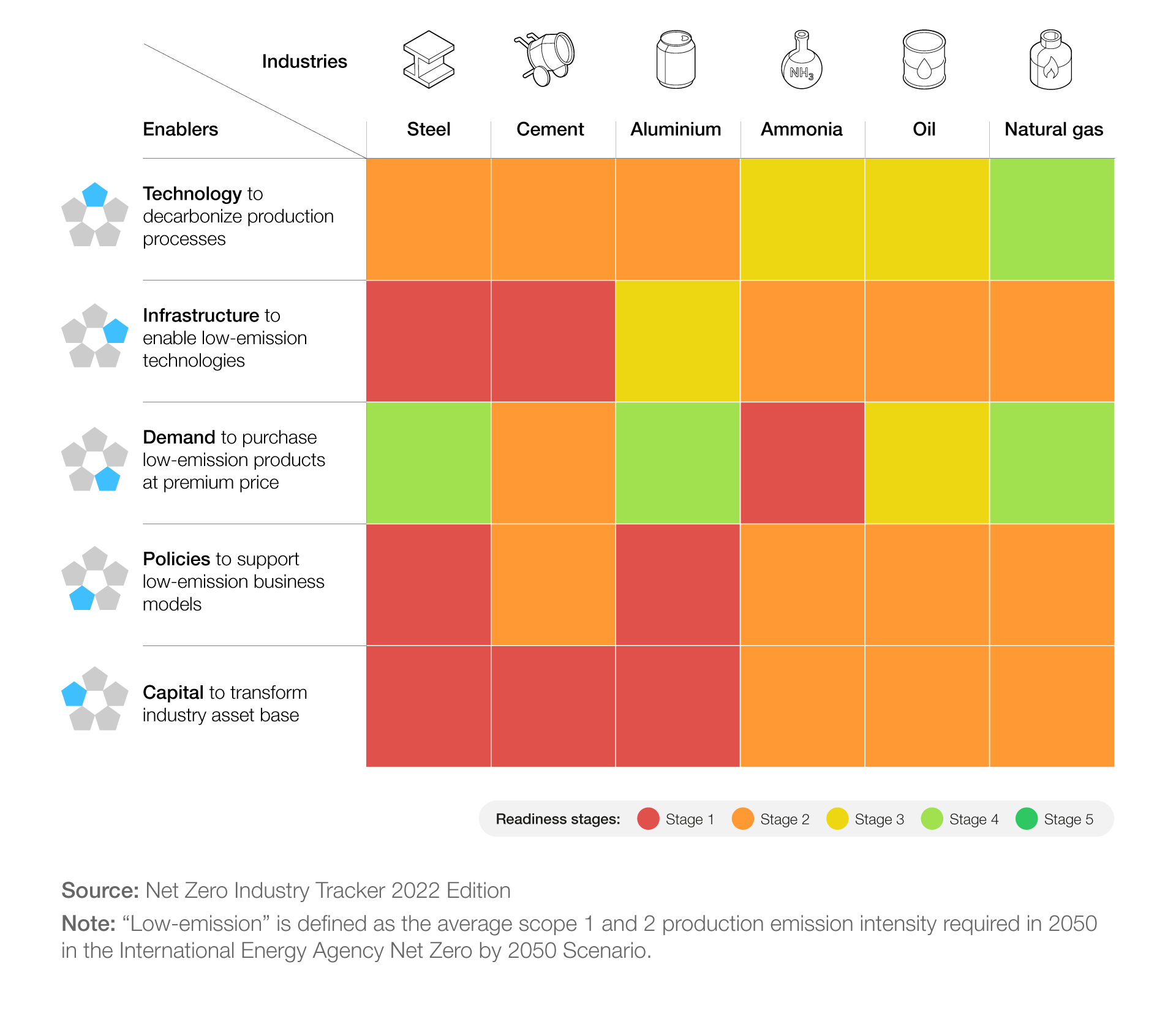

2. Set a public-private investment agenda to decrease the cost of clean technology

Many low-emission production technologies have been demonstrated at scale and can drastically reduce emissions, for example -80% for natural gas, -95% for cement plus steel and -100% for ammonia. However, these technologies are much costlier than traditional alternatives. At the current pace of development, low-carbon technologies won’t be commercially ready, let alone competitive, before the second half of the decade, which would mean 2025 for steel, and after 2030 for cement and aluminium. Moving forward, economies of scale, efficiency gains and further innovations are likely to drive costs down. But this can only happen if more full-scale projects are developed. Public and private sectors should come together to rapidly multiply such projects around the globe.

3. Promote low-carbon demand and establish transparency and visibility among producers

Decarbonising industries has estimated capital requirement of over 2 trillion USD in capital expenditure by 2050. Such investments can only materialise if demand and green premiums for low-emission products exist to grant producers and investors the returns they require. As of now, the willingness and ability of consumers to pay premiums have not been demonstrated. It is critical for industry stakeholders to strengthen and scale-up demand signals for low-emission products. Public and private buyers’ commitments are essential to provide visibility on green products’ offtake volume and price (for example the First Movers Coalition and Clean Energy Ministerial IDDI). Carbon footprint product labelling standards can also help differentiate materials and incentivise consumers to pay premiums.

4. Strengthen policies and regulations to level the playing field for low-carbon producers

Maintaining global competitiveness is a top priority for industry leaders and governments. First movers investing in higher-cost, low-emission production facilities assume a higher risk of seeing their competitive positions deteriorate. Stable and ambitious policy frameworks are necessary to level the playing field and incentivise firms to venture into low-carbon markets while governments need to facilitate the emergence of economically viable ones. Carbon pricing combined with a border-adjustment mechanism is one potential approach that limits the risk of carbon leakage. Others include carbon contracts, preferential public procurement (like the California Buy Clean Act), material mandates or quotas.

5. Develop risk-sharing mechanisms, green taxonomies, and public funding to de-risk investments and attract capital

Mark Carney, former governor of the Bank of England and UN Special Envoy on Climate Action and Finance, declared at Davos this year: “We need an energy transformation on the scale of the industrial revolution at the speed of the digital transformation. And therefore, we need a revolution in finance.”

The need for capital to decarbonise industries is immense. For instance, the additional capital expenditure required is equivalent to recapitalising 40% of the steel industry. To reduce companies’ risk exposure and accelerate capital inflow, innovative risk-sharing and financing mechanisms will be critical. Multilateral public-private partnerships, joint-ventures across industries and value chains, sustainable finance taxonomies, and public funding in the form of grants, low-interest and concessional loans and so on are a must to attract capital for the first commercial-scale assets.

All out means all in

Without radical change, industrial emissions will rise alongside demand for industrial products. The world should go all out to tackle the industry decarbonisation challenge. That means going all in on transparency and collaboration. It is only with collective effort that industries can reach net zero.

*Senior Managing Director, Global Energy Industry Lead, Accenture and Head of Shaping the Future of Energy & Materials; Member of the Executive Committee, World Economic Forum

**first published in: www.weforum.org

By: N. Peter Kramer

By: N. Peter Kramer