by Rich Barlow*

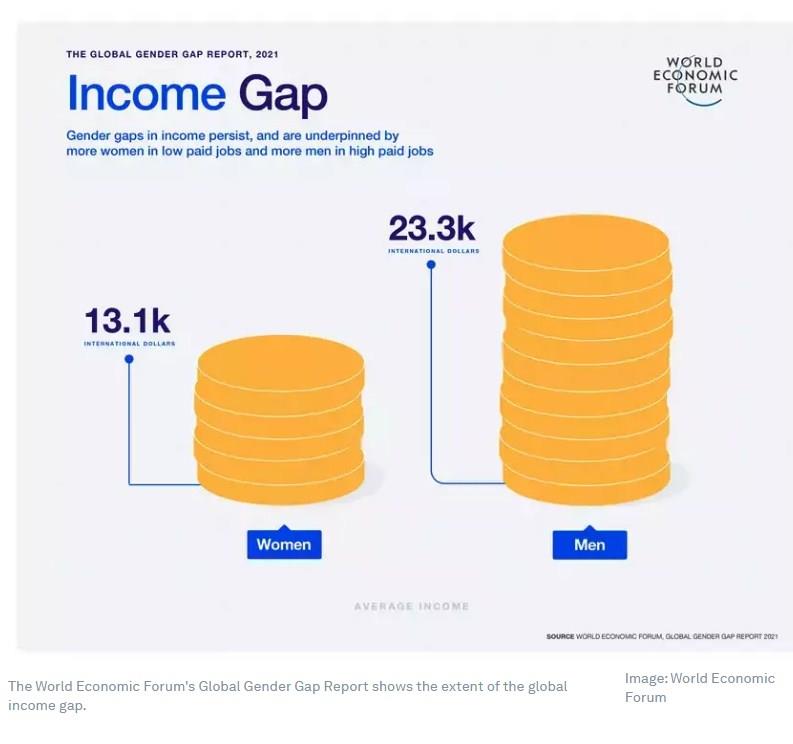

Men, notoriously, outearn women in similar jobs, with multiple inequalities leaving women in Greater Boston earning 70 cents to every dollar earned by male counterparts.

Although many people are working hard to close that wage gap, it has remained stubbornly wide. In the new research, Boston University labor economist Patricia Cortes has found less-than-obvious factors that may sometimes cause it to widen or narrow: risk aversion in women and overconfidence in men.

In a paper for the National Bureau of Economic Research, Cortes and her coauthors found that “intuitively, higher levels of risk aversion for women lead them… to accept jobs earlier.” Men, more cocky, hold out longer for a better offer. But that can be their downfall: waiting doesn’t always lead to better pay. The longer they wait, the lower the offers they tend to get, bringing their pay closer to that of their female peers.

“On average, more risk-tolerant students tend to accept jobs later, and there is a strong positive relationship between risk tolerance and accepted offer wages,” according to the paper.

Surveying 2,000 Boston University Questrom School of Business alumni and undergraduates from 2013 to 2019, Cortes and her colleagues found that women and men who accepted job offers later had a narrower pay gap than peers who accepted jobs earlier. That’s because men increasingly accepted lower-paying jobs over the search period.

Specifically, women who accepted job offers in August of their senior year were paid, on average, 17% less than men who took jobs that month. But among graduates who accepted job offers by the following October, the average pay difference between genders narrowed to 10%.

“In my view, 10% is [still] very high,” says Cortes, a Questrom associate professor of markets, public policy, and law, as well as an associate director of the Human Capital Initiative at Boston University’s Global Development Policy Center. “We’re comparing the outcomes of men and women who are in exactly the same program.” Cortes plans to share the findings with Questrom’s administration and students to better inform their job searches.

Here, Cortes explains the research and what it means for closing the wage gap:

Why does the gender pay gap narrow the later you accept the job offer?

Men tend to be more overconfident. Overconfidence means you think you’re better than you really are. If you’re risk-averse, you don’t want the risk of ending up with no job, so you have a lower reservation wage, a [minimum acceptable] wage you have in your head. If you think you’re really good, your reservation wage is higher: I’m not going to accept any job that’s less than $75,000.

It might be that he gets lucky and is offered a job of $75,000. [Or] it might be that his real quality is not that good, and he got this first offer of $70,000. He rejected it, and he never gets that offer again; he keeps getting $60,000. I’m not as good as I thought, he thinks, and his reservation wage goes down. He is likely to end up with a job in which he is paid less than a previous offer he rejected.

So, it isn’t necessarily that jobs accepted later pay better; it’s that men who wait that long have to accept lower-paying jobs that put them closer—

To what women are accepting at that point—exactly.

What made you originally suspect that risk aversion might play a role in the gender pay gap?

It’s from previous literature. Women have come a long way. Women are more likely now to go to college, they are less likely than in the past to take breaks for kids. Many of the things that will matter for explaining the gender gap have changed over time in favor of women. It still is the case that, especially for women at the top of the education distribution, there is a persistent gender gap. People started thinking about other potential explanations, new scholars studying differences in risk aversion, overconfidence, competitiveness.

Many papers have shown that women are more risk-averse. Why that is the case is a complicated question about, is it nature or nurture?

If you’re born with risk aversion, what can be done about it?

I wouldn’t say that you’re born with it. That’s up for discussion, and I would probably say it’s more nurture than nature, how women and men are raised. If it’s a permanent trait, [women] are actually doing what makes them feel better—comfortable. Despite men, on average, having higher wages at the end of the process, they report higher regrets with the job search and how happy they are with their jobs. There’s anxiety of not having a job that can also cause regret. Men turn out earning more, but that’s not necessarily the only outcome we care about.

*Senior Writer, Boston University

**first published in: www.weforum.org

By: N. Peter Kramer

By: N. Peter Kramer