by Frederic Simon

Energy taxation, carbon pricing policies and fossil fuel subsidies must be aligned more closely if the European Union wants to reach its 2030 climate targets, EU auditors said in a new report published on Monday (31 January).

Under the EU’s current Energy Taxation Directive, polluting energy sources like coal may have a tax advantage compared to more carbon-efficient ones, according to the report by the European Court of Auditors (ECA).

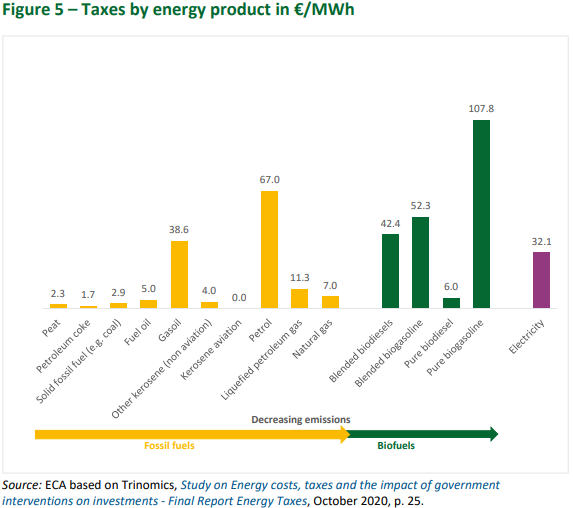

“For instance, coal is taxed less than natural gas, and some fossil fuels are taxed significantly less than electricity,” ECA said in a statement.

On average, coal is taxed €2.9 per megawatt hour while natural gas is taxed €7/MWh. Electricity, by comparison, is taxed €32.1/MWh, according to the report (see table below).

Fossil fuel subsidies

Moreover, fossil fuel subsidies – such as low taxes on petrol and diesel – have remained constant over the last decade, despite commitments from the European Commission and some EU member states to phase them out.

Overall, subsidies for fossil fuels amount to more than €55 billion per year and 15 EU member states spend more on fossil-fuel subsidies than on renewable energy subsidies, the auditors noted – a figure which doesn’t take into account the financial support given to poor households during the ongoing gas crisis.

As the European Union aims to halve its greenhouse gas emissions by the end of the decade, this kind of discrepancy cannot be allowed to continue, they warn.

The European Commission acknowledges this. In July last year, it tabled a revision of the EU’s energy taxation directive, which sets minimum tax rates for energy, including transport fuels and electricity.

The directive was last updated almost 20 years ago and is now “completely out of sync with our climate ambition”, the EU’s Economy Commissioner Paolo Gentiloni admitted when he unveiled the proposal last July.

According to the Commission, the revised directive seeks to promote “the take-up of electricity and alternative fuels” such as renewable hydrogen, synthetic fuels, and advanced biofuels.

The central part of the reform is a proposal to move the EU-wide taxation system based on volume – or euros per litre – to a tax system based on energy content or gigajoules.

“We try to encourage the use of biofuels, so by moving to a tax base according to energy content, we correct this hidden advantage to fossil fuels,” an EU official explained. This is because one litre of biofuel typically has a lower energy content than petrol or diesel even though the same tax rate applies.

Pushback

Revising the Energy Taxation Directive will be politically difficult though because it requires unanimity among EU member states, which means a single EU country is able to veto the reform.

And some have already expressed reservations. The Czech Republic, for instance, has warned against the social consequences of a sudden shift to greener taxation.

“The Czech Republic refuses any proposals that could lead to higher prices of energy products and electricity,” a spokesperson for the Czech finance ministry told EURACTIV.cz in December.

“There is the threat of massive resistance if we come with these proposals too vigorously and if we try to implement them quickly in the economic reality,” added Ondrej Kovarik, a Czech MEP from the centrist Renew Europe group in the European Parliament.

Czech worries are explained by the amounts that households spend on heating and transport fuels. For the poorest in Czechia and Slovakia, energy spending can represent more than 20% of their income, the EU auditors noted.

The report also pointed to the 2018 ‘Yellow Vest’ protests in France as a cautionary tale, noting that the movement was triggered by a carbon tax, which pushed up the price of petrol and diesel by €0.10 at the pump.

To alleviate the risk of rejection of tax reforms, the auditors pointed to a range of solutions, such as “reducing other taxes” or “applying redistribution measures” such as compensation for the most affected households.

“The main challenge, in our opinion, is how we strengthen the links between regulatory and financial measures and find the right mix between these two,” said Viorel Stefan, the member of the European Court of Auditors responsible for the review.

Another obstacle to the reform is Poland, which threatened to put its “veto on all matters that require unanimity in the EU” as long as the Commission does not release payments to Warsaw that are being withheld because of an ongoing dispute over the independence of Polish judges.

Poland also warned against the EU’s proposed green reforms more generally, saying they risk having a disproportionate impact on the poorest EU households in the current context of high energy prices.

*first published in: www.euractiv.com

By: N. Peter Kramer

By: N. Peter Kramer