by Meagan Andrews*

- The fast-growing sustainable investment sector is coming under scrutiny.

- Many investors are concerned by the possibility of greenwashing.

- Stronger definition of ESG products is needed, while investors must hold organizations to account.

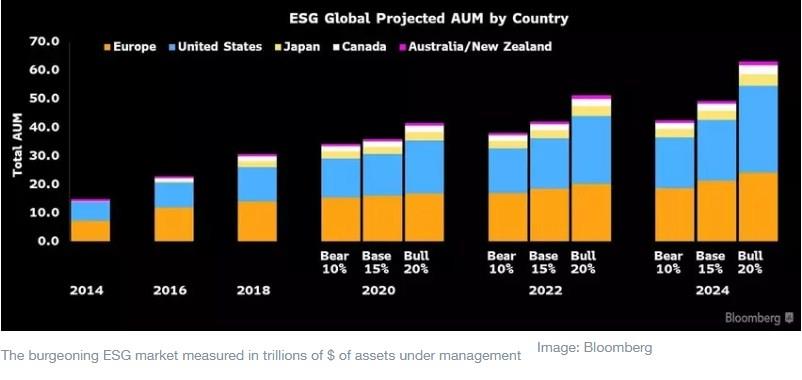

In a stark message in the wake of COP26, more than half of consumers across 17 markets believe investors and financial services companies have an obligation to help the environment and should be doing more. Enter sustainable investing! Sustainability-aligned investing has been growing fast: Bloomberg estimates that by 2025, more than $53 trillion could be invested globally in sustainability funds and portfolios.

Sustainable investing (or, as some call it, responsible investing) isn’t anything new, but it has undergone some evolution. What started a few decades ago as a somewhat basic ethical assessment of business activity has matured into a more thorough integration of environmental, social and governance (or, ESG) factors via quantitative and qualitative assessments.

This development aims to more precisely measure 21st century business risks that may have adverse societal or environmental consequences or affect financial performance – and identify corresponding opportunities. This has also birthed many new financial products, such as ESG-specialized exchange traded funds (ETFs) and green bonds.

However, there has recently been a healthy dose of scepticism raised regarding sustainable investing. Regulators (such as the US Securities Exchange Commission, the UK’s Financial Conduct Authority and the European Commission) are paying close attention to green claims and the construction of sustainable financial products. There are also other critics claiming sustainable investing might be doing more harm than good. So where does this pushback leave the industry?

Legitimate ESG concerns

There has been much discussion of the calculus of sustainable investing: What is the trade-off between ESG considerations and financial returns? How aligned is environmental due diligence with the fiduciary duty of an investor (i.e. their obligation to work in the best financial interest of their clients)? There is a growing consensus that incorporating ESG factors into the investment decision-making process is of critical importance for exercising fiduciary duty – but the debate is ongoing.

Meanwhile, as sustainability has risen to the top of corporate agendas, so too has the risk of greenwashing. In fact, it is a top concern of global institutional investors, cited by six in 10 respondents as an issue when selecting sustainable investments, according to a Schroders Institutional Investor study. It’s also been known to be a problem for retail investors, who especially struggle to decipher complex ESG investments.

The greenwashing challenge for investors is twofold. Firstly, when they make decisions about fund management firms or investment products (such as ETFs). In some cases, funds and products are exaggerating green credentials and portraying products, activities or policies as producing positive environmental outcomes (when this is not the case). So, for example, as a retail investor you might be investing in an ESG ETF that you find out is not too dissimilar to a non-ESG branded ETF. Secondly, greenwashing risks exist at the company level, which are the ultimate recipient of lending and equity allocations, with cases of misrepresentations of sustainability footprints or transition pathways.

Critics have also raised excellent points around the inadequacy of corporate non-financial reporting standards and the overriding need for government regulation.

There is no magic bullet or an easy fix to these problems. Despite the criticisms, sustainable investing is here to stay and has a role to play in securing a sustainable future. But that’s not to say that it doesn’t need to change.

How to improve ESG accounting and reporting standards

Accounting and reporting standards for ESG are currently inadequate. Corporate reporting of ESG factors is in its infancy compared to traditional financial reporting, particularly as there is no current legal requirement to disclose this. The World Economic Forum’s Stakeholder Capitalism Metrics work has sought to tackle the plethora of ESG reporting standards. The work, seen as a stepping stone for companies to use now, is building momentum towards the development of a global solution under the newly created International Sustainability Standards Board. This is not to say that ESG data and ratings should be perfectly standardized – there will, and should, remain room for varying approaches. However, being able to compare a portfolio across a core set of metrics should be possible.

In the same vein, there is also a need to streamline what makes a “sustainable” investment or financial product. The CFA Institute recently found that almost 80% of practitioners surveyed believe there is a need to improve standards around ESG products to mitigate greenwashing. This is something that regulators are already looking at closely – and there will undoubtedly be more measures to come.

Investors, who collectively have some of the greatest power to hold companies accountable, also need to use their voice. The industry must hold organizations (and themselves) to account on what ESG data is reported and how improvements are being made.

There’s also a way to go when it comes to developing the supply side of sustainable investing. Financial innovations such as green bonds, green loans and sustainability linked loans (SLL) have proliferated in recent years. But there remains much opportunity for innovation when it comes to financial instruments, and business models that can create an impact and be implemented at scale.

*Community Curator, Investors Industries, World Economic Forum

**first published in: www.weforum.org

By: N. Peter Kramer

By: N. Peter Kramer