by Pauline Bourgeon*

The pandemic has forced firms to adapt their work processes to the infection dynamics and the public health measures to contain it (OECD 2021). The massive expansion of working from home, for example, has dramatically altered where and how employees perform their jobs (Bartik et al. 2021). Estimates suggest that 40–60% of the workforce has been working from home (e.g. Bellmann et al. 2020a, Taneja et al. 2021). At the same time, disruptions in supply chains, delays in production, and changes in consumer demand have created many new uncertainties. While uncertainty about the future tends to reduce or delay investments, the need to limit personal contacts and tackle work disruptions might have boosted investments in new technology. Did firms adjust their digital infrastructure or did they abstain from new investments during the pandemic? Which firms have responded to the challenges of remote work, supply and demand disruptions? How did investments vary with the economic situation of firms?

We investigate these questions in the context of Germany, which constitutes a particularly interesting case because its digital infrastructure has been lagging behind (Academic Advisory Board of the Federal Ministry of the Economy and Energy 2021, OECD 2021). We rely on a large establishment survey “Establishments during the COVID-19 crisis” (Bellmann et al. 2021a, Aminian et al. 2021) run by the Institute for Employment Research (IAB) since August 2020. The data cover 1,941 establishments all across Germany, which were surveyed by phone in February 2021. The results are weighted to be representative of all private establishments with at least one employee subject to social security contributions (Bellmann et al. 2021b).

Did firms invest in digital technologies?

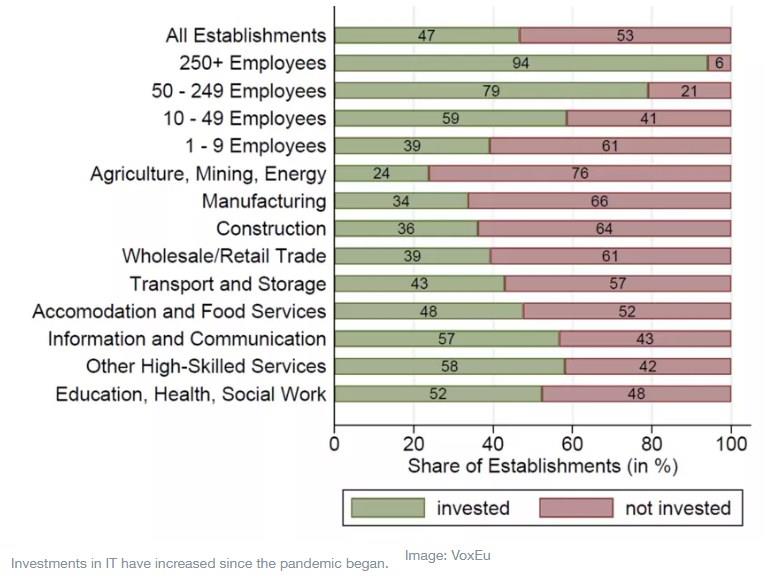

Since the start of the pandemic, almost half of all establishments have invested in digital technologies such as hardware, software, or digital infrastructure (see Figure 1). Larger establishments are much more likely to invest. Among establishments with at least 250 employees, almost every establishment undertook investments – while only 39% of establishments with fewer than 10 employees did. Investments were most prevalent in the information and communication sector (57%) and other high-skilled services1 (58%) but much less so in manufacturing (34%), construction (36%) and retail (39%).

Figure 1 Investments in IT or digital technologies since the start of the COVID-19 pandemic

Note: The figure shows weighted percentages based on 1.941 establishments surveyed in February 2021.

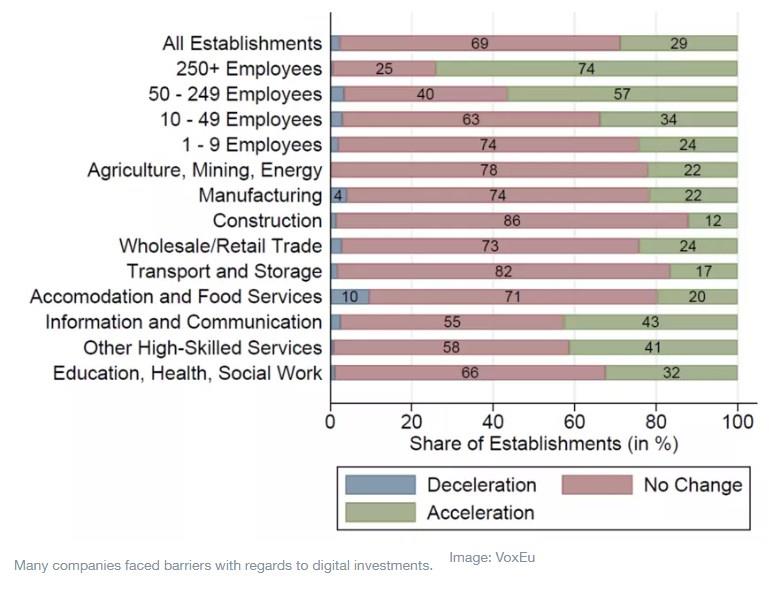

An important question is whether the pandemic has really accelerated the diffusion of digital technologies or whether these investments would have occurred even without the pandemic? Almost 30% of establishments report that the crisis has indeed accelerated the introduction or expansion of digital technologies in their establishment (see Figure 2). At the same time, 69% report no change in investments, while 2% of establishments say that the crisis has decelerated the diffusion of digital technologies.

The overall numbers again hide vast sectoral differences. Establishments in information and communication, education, health and social work, and other high-skilled services are most likely to have sped up investment. In construction, transport and storage – sectors where working from home is difficult – establishments are much less likely to invest, however. In accommodation and food services – a sector heavily affected by demand disruptions during the lockdowns – 10% of establishments say that the crisis has even reduced the speed of diffusion for digital technologies. There is also a stark divide by establishment size: almost 75% of large establishments view the pandemic as an accelerator of digitalisation, while only about one-fourth of small and one-third of medium-sized establishments share that view.

Figure 2 The COVID-19 pandemic and the diffusion of digital technologies

Note: The figure shows weighted percentages based on 1.941 establishments surveyed in February 2021.

Establishments that did not invest in digital technologies mostly say that investments were not considered necessary. Only 15% of establishments indicate that investments would have been too expensive and 12% report that planning and implementation would have been too complex. Such barriers to investment are much more relevant for small and medium-sized establishments, which are more likely to have liquidity shortages. High costs were considered an important investment barrier in the retail sector and in accommodation and food services, two sectors particularly affected by the public health measures to contain the pandemic.

Which digital technologies have firms invested in?

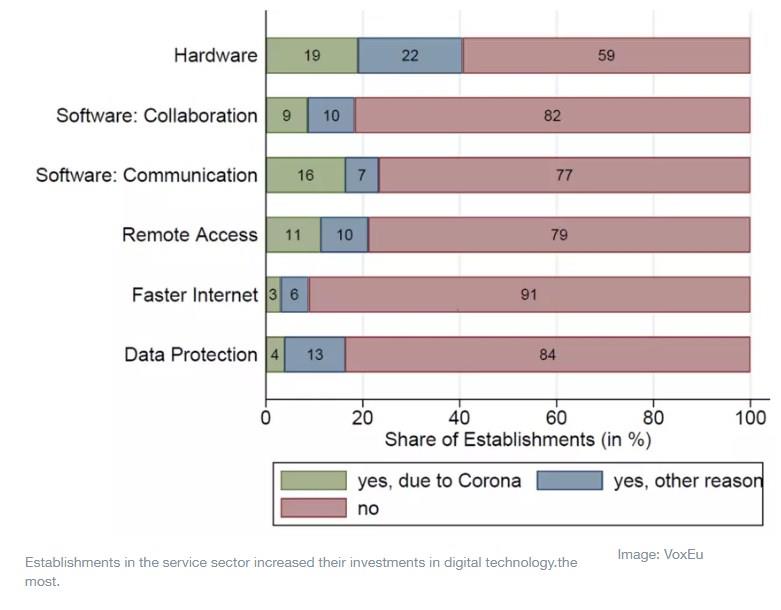

The survey also asks establishments about the type of digital technology they invested in. We distinguish between hardware (such as computers, laptops, smartphones or headsets) and software for joint document management and collaboration purposes (such as SharePoint or Google Docs) and software for digital communication and process automation (such as Microsoft Teams or Zoom). Other investment categories are remote access, internet speed, data protection and IT security and, finally, additional IT staff. Figure 3 shows that hardware was the most important type of investment (41%). Investments in software are also common, especially communication and process automation software (23%) followed by investments in collaboration software (19%). Investments in faster internet (9%) or additional IT staff (2%) were much less prevalent.

Not all of these investments were made because of the COVID-19 pandemic, however. Figure 3 reveals that the pandemic has mostly spurred investments in communication software. Communication tools such as Teams or Zoom are important digital tools for coordinating and communicating work processes effectively if employees are separated physically. As such, they are an important complement to the widespread expansion of work from home. Moreover, almost half of the establishments that invested in hardware, in software for collaboration purposes and in remote access have done so because of the COVID-19 pandemic.

Figure 3 Type of investments in IT or digital technologies

Note: The figure shows weighted percentages based on 1,941 establishments surveyed in February 2021.

Interestingly, it is mostly establishments in the service sector that significantly increased their investment in all types of digital technologies. Establishments in education, health and social work primarily invested in hardware and communication software, while establishments in information and communication mostly invested in collaboration software. Again, COVID-19-related investments in IT and digitisation are much more likely in larger establishments, particularly with respect to hardware and remote access.

How have economic conditions affected investment?

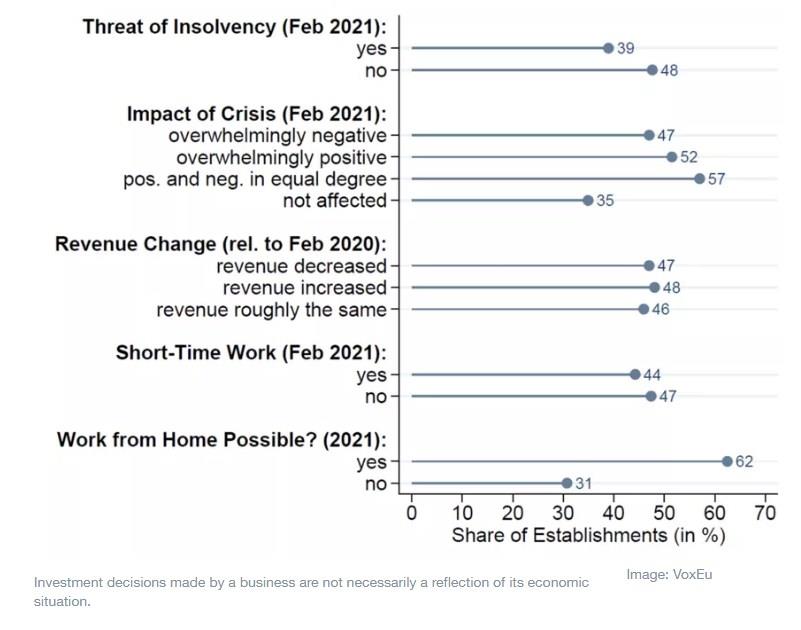

The substantial variation in investment responses across sectors could indicate that the economic conditions firms faced might have encouraged or inhibited investments in new technologies. Indeed, Figure 4 shows that the economic difficulties businesses experienced during the pandemic left their mark. Establishments at the brim of insolvency in February of 2021, one year into the pandemic, are less likely to invest than establishments not concerned about their survival – though the difference (9%) is smaller than one would think. Also, establishments that were overwhelmingly negatively affected by the crisis in February 2021 are less likely to invest. Interestingly, establishments are least likely to invest in new technologies if their business was not affected by the pandemic at all. Hence, the shock of a global pandemic and the associated economic vulnerabilities accelerated firms’ decision to update their digital infrastructure. One very important driver of investments in digital technologies was the option of having employees work from home. Sixty-two percent of establishments that could allow work from home invested in digital technologies, but only 31% of establishments that saw no room for telework.

Figure 4 Investments in IT and digital technologies by economic conditions

Notes: The figure shows weighted percentages based on 1,941 establishments surveyed in February 2021. Information on whether work from home is possible comes from survey waves in January, March and April 2021 and is available for 1,506 establishments.

The actual economic situation of a business seems to be not so important for investment decisions. Establishments that use short-time work to smooth a temporary decline in production or service delivery are equally likely to invest than establishments with no short-time work. Similarly, the decision to invest in digital technologies does not differ much between establishments with declining revenues and establishments and those with increasing revenue over the past year. These patterns indicate that establishments reacted more to the shock of a global pandemic and less to the current economic situation.

Discussion

In Germany, roughly 50% of all establishments have invested in some form of digital technologies; and 30% of all establishments consider the pandemic an accelerator of digitalisation. Investments are particularly prominent in large firms, while small and medium-sized firms are less likely to invest and more likely to face financial or logistic barriers to investment. Hardware represents the most common type of digital investment, while investments in communication software were accelerated the most in the pandemic.

The possibility to have employees work from home is one important driver for updating the digital infrastructure. Yet, even establishments where working from home was not an option invested in digital technologies. For the decision to invest, the experience of a global pandemic, a massive aggregate shock, seems to have been more important than the current economic situation of an establishment.

The pandemic not only forced firms to adapt rapidly to a health crisis; it also accelerated the diffusion and use of digital technologies, especially in combination with working from home. These investments, their associated changes to firms’ work processes and more flexible work arrangements are here to stay permanently (Baldwin 2020, Barrero et al. 2021).

*Research Associate, LISER

**first published in: www.weforum.org

By: N. Peter Kramer

By: N. Peter Kramer