by Vik Krishnan, Darren Rivas and Steve Saxon*

If things go well, we might be at the threshold of a new age of travel. Although COVID-19 variants may affect conditions, it seems only a matter of time before travelers in some parts of the world hit the road and take to the skies again, thanks to rising vaccination rates and manageable caseloads. Some countries have begun gingerly relaxing travel restrictions and reopening borders.

As the worst effects of the COVID-19 pandemic ebb, most indicators point to travel coming back—with a vengeance—as people look to reconnect, explore new destinations, or revisit reliable favorites. Many just want to get away from the confines of their homes. A McKinsey survey reveals traveling to be the second-most-desired activity among respondents (in first place: dining out). In the United States, air travel has hit two million daily passengers, closer to the prepandemic level of around 2.5 million than to the low of around 90,000, in April 2020. Hotel reservations and rental-car bookings are surging.

All these trends should taste sweet for the industry, but ill-prepared companies may find themselves facing the wrath of a cohort of leisure-focused vacationers who might already be struggling to keep up with new travel protocols. If the industry doesn’t work to increase capacity now, the ecosystem may buckle under the pressure, forcing travelers to endure long wait times and inflated prices.

This article projects two broad trajectories of how travel will likely bounce back, comparing countries that have near-zero caseloads with those that have more, but manageable, caseloads and higher vaccination rates. In both scenarios, travel companies that don’t prepare themselves for the forthcoming influx of travelers risk missing out on a valuable opportunity to recoup losses incurred during the height of the pandemic. On the flip side, we believe that by focusing on four key areas—building capacity, investing in digital innovation, revisiting commercial approaches, and learning from critical moments—travel companies can seize value as they exceed the needs and demands of their customers.

The tale of two travel recovery paths

Wherever in the world you look, you’ll see people itching to travel. Most high-income earners have not lost their jobs. In the United States, the savings rate among this demographic is 10 to 20 percent higher now than before the pandemic, and such people are eager to spend their money on travel. Leisure trips are expected to lead the rebound, with corporate travel trailing behind.

A recent survey of 4,700 respondents from 11 countries around the world, conducted by the International Air Transport Association (IATA), revealed that 57 percent of them expected to be traveling within two months of the pandemic’s containment, and 72 percent will do so as soon as they can meet friends and family. In our China travel survey, we see more and more respondents yearning for leisure trips further afield; 41 percent say they want their next trip to be outside China, the highest level we’ve seen, despite borders remaining sealed.

Yet it’s worth noting that despite the near-universal desire to travel, countries will likely manage their plans to reopen differently. Two main factors come into play here: current COVID-19 caseloads and vaccination rates. People living in countries with limited access to vaccines and uncontainable levels of cases—such as a number of countries in Africa and Southeast Asia—will continue to be bound by tight travel restrictions for some time to come.

Travel will take off in and between countries with manageable caseloads

We can expect a surge in travel in (and between) countries with manageable and moderate COVID-19 caseloads and vaccine access. These regions are willing to accept rising case levels as long as death and hospitalization rates stay low. In many European countries and the United States, a significant portion of the population has been inoculated. Such people feel safe enough to travel both domestically and internationally, especially with the introduction of safety measures such as the EU-issued digital health certificates given to people vaccinated against COVID-19. Despite fluctuating rates of new caseloads in these regions, the efficacy of the vaccine so far (to reduce the spread of the disease and avoid its worst effects) gives many people enough feeling of security to travel.

Countries in Europe that have gotten used to living with manageable caseloads of COVID-19 have begun to welcome visitors without asking them to quarantine: Iceland (March 2021), Cyprus (May 2021), and Malta (June 2021). In addition, Europe is open to vaccinated US travelers. After the US Centers for Disease Control and Prevention (CDC) started approving cruise vessels with conditional sailing certifications to enter the country, a Florida federal court ruled in June 2021 that CDC-issued regulations should serve only as nonbinding guidelines, further reducing restrictions on tourists.

If past instances serve as indicators, we’ll see travel demand soaring once travel restrictions are eased and freedom of mobility returns.

Domestic trips will lead the recovery of travel in near-zero countries

However, a slightly different picture is emerging for countries with near-zero caseloads. Countries in this group include Australia, China, New Zealand, and Singapore. Their governments face a difficult trade-off. They can open up national borders without quarantines—which will almost certainly lead to increased local transmissions of COVID-19 and an increase in new cases, especially in countries with low vaccination rates, such as Australia and New Zealand. Or, they can choose to continue imposing strict restrictions and quarantine measures until the pandemic has truly passed, which would deter all but the most determined of travelers. Unlike places that have adjusted to living with COVID-19, even a moderate increase of cases in countries with caseloads near zero would likely be unacceptable to the public.

That’s not to say there are no travel opportunities in these countries. First, we’ll likely see increased interest in domestic travel, especially for large countries with sizable home markets, such as Australia and China, which have traditionally been net exporters of tourists. With few international destinations open to visit, this group of travelers will likely seek out vacation experiences within their nations’ borders. China has seen hordes of tourists flood many scenic destinations and tourist sites, especially during peak travel seasons.

Second, even though travel bubbles have had only limited success so far, it may soon be possible for territories with very low COVID-19 caseloads and no local transmissions to open up access to each other. Mainland China, for instance, has been allowing citizens to travel to and from Macau without quarantine requirements. Hong Kong and Singapore have also restarted negotiations on a potential travel bubble between the two cities. The key is establishing common standards and trust in the public-health protocols and testing regimes of the participants in the travel bubble.

Four actions travel players must consider

Despite these promising signs, the tourism industry will likely struggle to capitalize on the imminent spike in travel demand, especially in Europe and the United States. From airlines and car rentals to hotels and airport restaurants, the entire travel supply chain is already showing signs of strain. Wait times at security checkpoints are stretching into hours at some airports, while popular vacation destinations, including Arizona, Florida, and Hawaii, are facing rental-car shortages.

Needless to say, bad news travels fast, and a negative experience can quickly become fodder for a viral video and bad publicity, leading customers to look for alternatives more in their control, including nearby drives and rental properties.

While the process is daunting, clear-sighted travel leaders know that preparing their organizations for a surge of travelers is also an opportunity to redefine their value propositions and make their offerings distinctive. This will not only reinstill confidence in travel but also increase customer loyalty. Leaders and executives would be wise to focus on the following four areas.

1. Bring back capacity

The most pressing imperative for all companies across the travel supply chain is bringing back capacity or, at the very least, ensuring that they’re able to do so. Many contract and temporary workers in the restaurant industry who were laid off during the pandemic have found other employment and are reluctant to go back to their former jobs, resulting in a labor crunch. In the United Kingdom, more than one in ten workers left the hospitality sector last year. In the United States, there was still a shortfall in April of around two million leisure and hospitality jobs—far greater than before the pandemic. Global aviation capacity levels are still well below prepandemic levels as many planes remain in long-term storage and staff remain furloughed. We believe that even though reactivating airline pilots and cabin crews, preparing grounded aircraft for service, and rehiring and training service staff can be pricey, the cost of standing by and doing nothing would be higher.

2. Invest innovatively to improve the entire customer journey

While cash might continue to be in short supply, an area still worth considering for overinvestment is digital operations. Remember that the customer experience is shaped across the entire end-to-end journey, from booking to travel to the return home. Even seasoned travelers will have to adapt to new protocols, such as digital health certificates and safety measures. Travelers now need more, not less, assistance. Furthermore, certain critical journeys and moments—such as a family vacation, an important business trip, or a last-minute emergency—carry a disproportionate weight in consumers’ minds when they plan their next trip. The anticipated volume of traffic during the summer and peak holiday periods will only compound these issues and bring about greater inconvenience in the overall system.

In our work in this sector, we have found that if even one pain point in the customer journey is not satisfactorily resolved, the entire perception of a travel company can be degraded. The industry needs to make sure that processes are smooth for reopening and that adequate assistance is available for travelers to help them adapt to new ways of traveling. It is likely that international trips will need additional documentation for some time. These requirements will vary by country and potentially by transit hub. They may include proof of COVID-19 vaccination (when, as well as which vaccine) and testing requirements (type of test and recency).

As the long wait times at airport checkpoints attest, manually navigating these complexities at the check-in desk is highly inefficient and prone to human error. Some airports are testing camera-powered and AI-based digital technologies to monitor crowd densities and reduce time spent standing in line—which makes the airport experience more bearable for travelers and ensures safe physical distancing. Autonomous robots are also being deployed to maintain hygiene standards; some are equipped with UV-light cleaners to disinfect areas, and others are outfitted with body-temperature sensors to help minimize the risk of virus outbreaks.

3. Reimagine commercial approaches

Travel companies may rethink their commercial approaches. The profiles of airline passengers and hotel guests will be different: more leisure guests, later booking windows, and higher demand for flexible tickets. Historical booking curves are no longer a good indicator of current behavior. Travel companies need to use every source of insight they can to anticipate demand and optimize pricing. Flexible pricing models can also ease customer discomfort with today’s heightened levels of unpredictability. For example, EasyJet now offers a Protection Promise program that gives fliers free changes up to two hours before the flight.

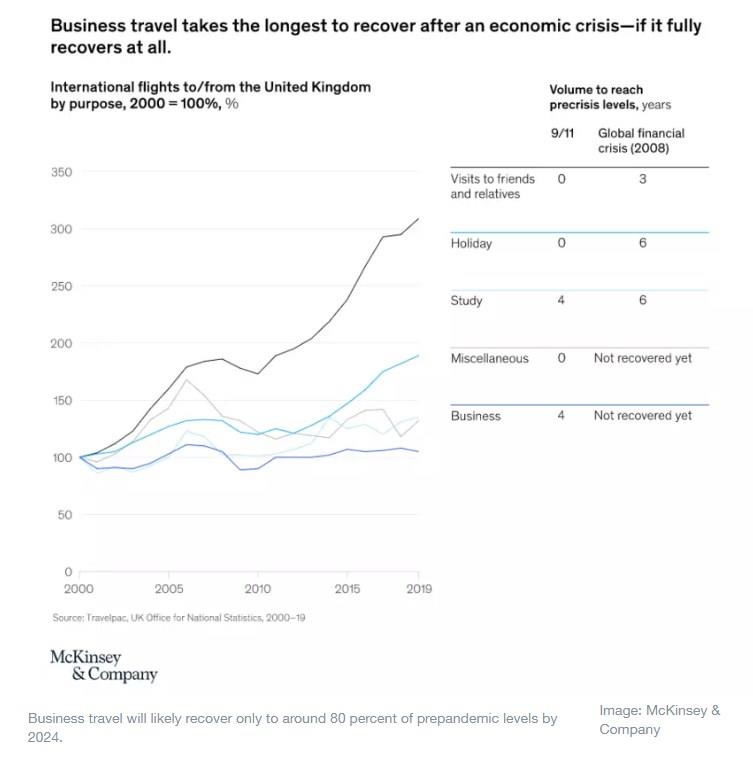

Hotels will need to find new purposes for meeting and conference spaces, which will be slower to fill. Airlines need to figure out how to fill intercontinental business class, likely with premium leisure promotions. For all travel companies, the boom may be higher in traveler numbers than in profits, as the most lucrative corporate business has been slow to return.

4. Learn from critical moments—and the wider ecosystem

Aside from streamlining processes and personalizing the customer experience, investing in digital analytics can allow companies to identify opportunities to differentiate their services. Companies would also be able to discern emerging trends and hiccups before they turn into nightmares. Industry players, such as online travel agents, may also be a trove of useful insights pertaining to how the external ecosystem is evolving; their experiences may be beneficial for hotels and airlines to explore potential partnerships with them.

The various parts of the travel industry have to work together as a whole to usher in a safe return of travel. Even as individual companies improve their internal operations, they should also keep a close eye on industry-wide developments, watching for collaboration opportunities. The industry and governments will have to reach consensus on safety standards and requirements. The IATA travel pass is a plug-in that could be used on airlines’ mobile apps, for example. Currently being tested by many airlines as a way to ensure passenger health, the app would allow travelers to manage verified certifications for COVID-19 vaccines and test results. Governments, in turn, could consider accepting and embedding the app into the flight check-in workflow.

It’s been a long time coming, but we see several factors aligning that could lead to a short-term travel boom, although not all countries and customer segments will boom at the same time. With continued perseverance, travel companies can ensure that travel is not just back but better.

*Partner, Mckinsey& Company and Associate Partner, Mckinsey& Company and Partner, Mckinsey& Company

**first published in: www.weforum.org

By: N. Peter Kramer

By: N. Peter Kramer