by Frederic Simon

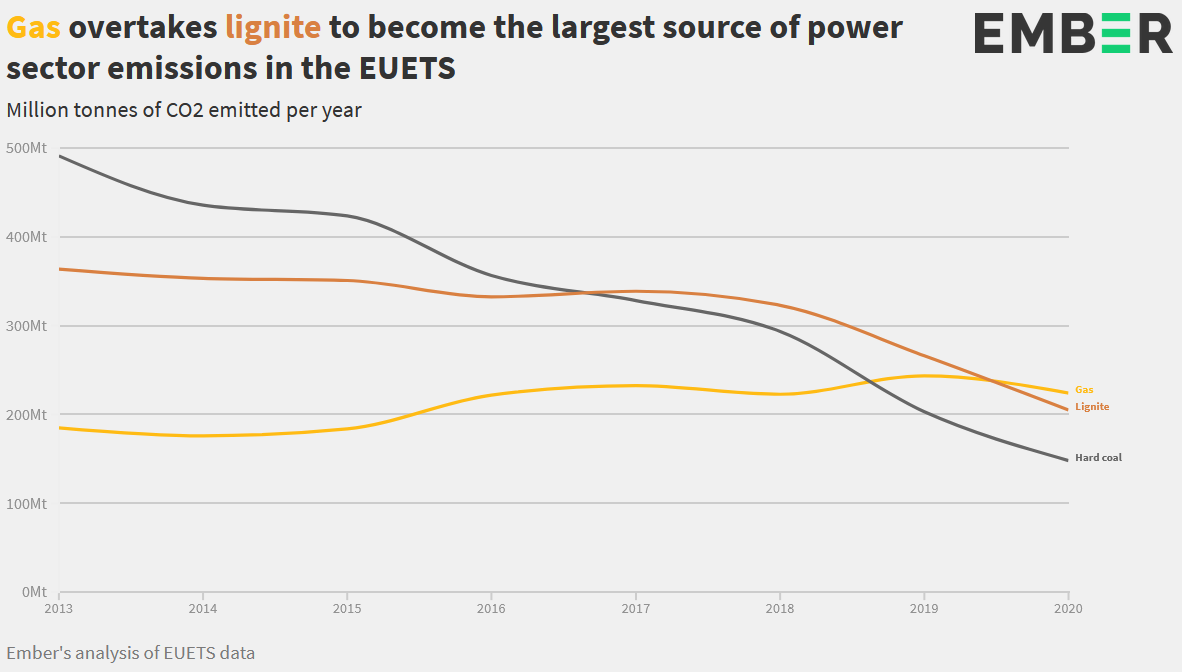

Gas power plants overtook lignite in 2020 to become the EU’s single largest source of power sector emissions, according to fresh analysis from energy think tank Ember.

The analysis, published on Friday (16 April), is based on data reported by energy companies covered by the EU’s emissions trading scheme, which puts a price on each tonne of CO2 emitted by more than 10,000 large industrial installations.

It showed a continued downward trend in emissions from lignite and hard coal power plants, which dropped respectively by 23% and 27% last year compared to 2019.

“The fall in lignite emissions in 2020 meant that – for the first time – gas power plants overtook lignite power plants to become the single largest contributor to power sector emissions in the EU ETS,” Ember said.

Europe’s gas plants released 236 million tonnes of CO2 in 2020, more than lignite (205MtCO2) and hard coal (154MtCO2), according to data compiled by Ember. In 2020, gas power plants represented 33% of power sector emissions in the EU ETS, up from just 16% in 2013.

Lignite is the highest carbon-emitting source of power generation, but historically also one of the cheapest. However, a robust carbon price and low gas prices in 2020 meant gas generation was the cheapest form of fossil generation last year, even undercutting lignite.

“Gas is the new coal,” said one Brussels energy lobbyist who spoke to EURACTIV on condition of anonymity.

Charles Moore, an analyst at Ember, said the drop in coal “coincides with the rise in carbon prices” on the EU emissions trading scheme, combined with a rapid deployment of wind and solar.

“That is your trend: wind and solar pushing out coal,” which has become relatively more expensive over the years, Moore told EURACTIV.

But the rise in carbon price has also caused a short-term growth in demand for gas in electricity generation, Moore said.

“There’s an underlying small upward trend” in gas consumption, he explained, saying there has been “undoubtedly a coal-to-gas switching driven by the carbon price”.

Emissions from gas power plants have been relatively stable over the past years though, reaching 227MTCO2 in 2016. A peak was reached in 2019 when gas power emissions reached 250MtCO2, and fell back to 2017 levels in 2020.

Looking ahead, Moore said he expects fossil gas consumption in the electricity sector to drop further as Europe adopts tougher climate objectives.

“Certainly in the power sector, we expect demand to drop quite considerably over the next decade,” he said.

That appears to be in line with industry expectations.

In February, Siemens Energy AG announced it was planning to cut 7,800 jobs from its gas and power division by 2025 as the company adjusts to a market that is moving away from fossil fuels and towards renewables.

“The electricity market is undergoing a fundamental transformation. It is changing rapidly in the direction of renewables and decarbonisation solutions,” said Christian Bruch, CEO of Siemens Energy as he unveiled the company’s first-quarter results.

“By energy source, this means: clear growth in wind and solar – from which Siemens Gamesa will benefit; flat development in natural gas, nuclear and hydropower; and a decline in coal and oil,” he said.

“To sum it up: The market is growing faster than average outside our traditional markets of Gas and Power,” Bruch said, announcing that the company will refocus on low or zero-emission power generation, transport, storage and digitalisation.

For Moore, this should send a clear warning to countries like Poland, which are looking at gas to replace some of their loss-making coal power stations.

“If you made a decision today to replace a big coal power station with a gas one, that will take until 2025 or 2026 to build. This means your glory years will have been spent in construction” before they become obsolete, he said.

*first published in: www.euractiv.com

By: N. Peter Kramer

By: N. Peter Kramer