by Kristian Teleki*

The global financial crisis of 2008 had catastrophic effects on all elements of society with very few economies left untouched. It resulted in a global recession that was the most severe since the Great Depression of the 1930s. This was caused by too much risk-taking in a seemingly flourishing economy; drawing down too many resources to extend business and profits with short-term gains; and policies, regulatory mechanisms and institutions that were simply too lax and ineffective. Millions of people lost their jobs, homes and livelihoods, and large amounts of their wealth disappeared overnight.

Out of the ashes of this crisis rose a new dawn for global finance, where greater scrutiny and oversight of banks and other financial institutions became the norm. Governments loosened fiscal policy more strategically to stimulate and support economies, but not to the detriment of society. International entities were established, such as the Financial Stability Board (FSB), which was set up by the G20 to monitor and make recommendations about the global financial system and avoid a cascading global economic collapse from happening ever again.

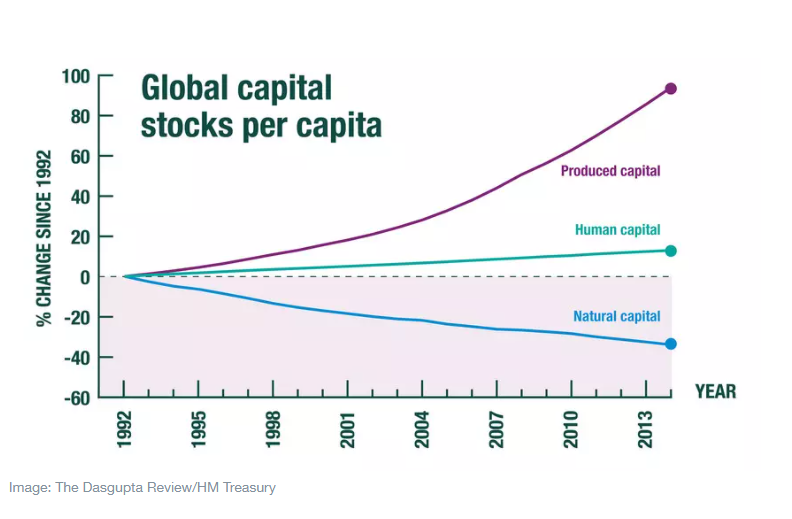

These lessons and responses from the financial world should be a stark warning for the current plight of our natural world. For decades, we have failed to manage our global portfolio of assets sustainably – that is the mix of produced, human and natural capital – as we have depleted our natural capital significantly. Estimates show that since the early 1990s, produced capital per person has doubled and human capital per person has increased by about 13% globally, while the stock of natural capital per person has declined by nearly 40%.

Just imagine, how would global financial markets react if 40% were wiped off balance sheets and countries’ GDPs were spiraling sharply downwards? They would take drastic collective action, unequivocally so, to avoid catastrophic impacts on the very fabric of life on this planet. Yet this is the very trajectory we are on at the moment when it comes to nature – but the required urgent action is conspicuous by its absence. By drawing down on our natural capital to such an extent, we are taking enormous and disproportionate risks, without regulatory mechanisms being universally applied. We are failing to invest in these assets even though they underpin the fundamental elements of every aspect of our lives.

Our health, livelihoods and economies depend on nature. As the Nature Risk Rising report found, more than half of the world’s GDP is highly or moderately dependent on nature. We are nearing irreversible tipping points and we will all pay a high price for not acting now. The COVID-19 pandemic has brought our dysfunctional relationship with nature into sharp focus, and has devastatingly demonstrated that we ignore nature – and its associated biodiversity – at our peril. While humanity has been prospering immensely in recent decades, this has come at a high cost to the natural world, with overfishing rampant, deforestation unabated and extinction rates of biodiversity 1,000 times higher than any time in human history.

We are even seeing global systems like the ocean, once thought to be inexhaustible and able to withstand anything humanity did to it, in serious trouble. Work by the WWF has estimated that the global ocean is a $24 trillion asset, and goods and services from coastal and marine environments amount to about $2.5 trillion each year – putting the ocean as the seventh largest economy in the world in terms of GDP. This is one of the planet’s key savings accounts from which we keep making only withdrawals, even though to continue in such a way can only lead to bankruptcy. We simply cannot afford to let this happen and the World Economic Forum’s Friends of Ocean Action is driving much-needed transformative change. It is time for significant reinvestment and protection of this and other global nature commons. It is time for us to invest in nature.

The Economics of Biodiversity: The Dasgupta Review, released today, underscores our unsustainable engagement with nature and the urgent need to act. It shines a clear light on the extent of the unsustainable relationship between humanity and nature. The Review shows that deep-rooted institutional failure, including short-termism, has led us to collectively fail to engage with nature sustainably, to the extent that our demands far exceed its capacity to supply us with the goods and services we all rely on. Yet we continue to enable and exacerbate this decline by subsidizing activities which are damaging nature, estimated to be around $4-6 trillion per year, and not bringing to bear the full force of governance and regulatory mechanisms desperately required to slow this unimaginable pace.

The Dasgupta Review makes clear that learning from the past is important, but that now is not the time to dwell on it. We must look forward, and the Review outlines the steps to take now to change this state of affairs. And we all have a role to play.

Ending the decline in nature and thus reversing biodiversity loss will require us all to take action. Changing our measures of success so that it includes the value of nature at the global, national, local and corporate levels; and moving to a measurement of stocks rather than flows will allow us to identify whether we are truly on a sustainable path to improved wellbeing. Our global financial system needs to be one in which measuring and managing dependencies, impacts and nature-related risks becomes the norm not the exception. A true understanding of the ecological impacts and consequences of our consumption and production patterns will encourage behaviour change, like opting for more sustainable diets and reducing waste.

We need everyone to feel empowered to make informed decisions and hold other actors to account who are taking decisions that deplete nature and sustainability on our behalf. Ask the right questions and demand transparency on the ecological impacts of supply chains and financial investments. One of the aims of the Dasgupta Review is just this: to make available the knowledge and language to discuss these problems and demand change. But we should not stop with one or two generations – we must henceforth include the natural environment in our children’s curricula. That a new qualification in natural history will be introduced in schools in the UK from next year is a promising step that should be emulated by other countries.

Each and every one of us is a steward of nature and has a responsibility to invest in and protect this most precious asset we all depend on. Government leaders have a historic opportunity to safeguard nature through smart policies, and those in the world of finance must also leave behind the prevailing disregard for nature and invest instead in a thriving planet. A community of leaders, Champions for Nature, is working to halt nature loss this decade and highlight the vast business and economic opportunities of safeguarding our natural assets. Investing in a nature-positive economy in key sectors could create up to $10 trillion in additional annual business revenue and cost savings and 395 million jobs by 2030.

Members of Friends of Ocean Action, meanwhile, are fast-tracking solutions for a healthy and thriving ocean like piloting and scaling innovative new financial mechanisms to increase levels of finance flowing towards the ocean, to realize the true potential of a sustainable blue economy.

The Dasgupta Review clearly shows the choice humanity faces – we can either retreat into business as usual, with all the destruction that this will continue to entail. Or we can use this moment in time to leap forward and come together for a common purpose and seek a better world, where we regenerate nature to build resilience and health. I know which side of history I want to be on.

Surely it is time to nurture nature as though our lives depend on it. Because they do.

*Director of the Friends of Ocean Action, World Economic Forum, and Director, Sustainable Ocean Initiative, World Resources Institute

**first published in: www.weforum.org

By: N. Peter Kramer

By: N. Peter Kramer