by Robert (Bob) Ayres and Jeroen van den Bergh*

The incoming Biden and Harris team faces multiple crises requiring its immediate attention: the Covid-19 epidemic, a deep economic crisis and dangerous climate change. The risk for any new administration is that political fighting over parallel legislative proposals, each with passionate backers, may result in nothing important getting done. It is conventional wisdom that any newly elected president of the United States gets one and only one important piece of legislation enacted into law.

We believe a policy prescription could address the urgent climate, inequality and post-Covid issues simultaneously. At its core is a variant of what is known as “universal basic income” (UBI). This denotes a government programme that provides health care for all as a right and a monetary “dividend” on the productive capital stock created by prior generations. It would be payable monthly to every citizen above a specific age, with no conditions attached. It would avoid the need for multiple targeted social programmes that involve costly bureaucratic control.

Funding UBI would require a fundamental change in taxes, resulting in a scheme combining three important social purposes at the same time:

-to reduce the extreme economic inequality in our society

-to eliminate absolute poverty and to increase social welfare, both physical and mental

-to sharply reduce consumption of material goods created in environmentally harmful ways.

How we pay for it

To many on the left, funding UBI can be done by taxing the incomes or wealth of the rich. If that is not enough, governments should borrow from future income and spend the money today, hoping that future growth will make the deficit go away. Even with Democrats in control of the US Senate, taxing the rich seems fraught with challenges. Can we assume that increasing the national debt and spending the money will pay for itself by stimulating growth? That was the Republican argument for both the Reagan and Trump tax cuts of 1983 and 2017. But growth did not accelerate in either case, while economists do not expect high growth in coming decades. Our proposal is to change the existing tax system in several ways that are more appropriate for the 21st century. The basic contours of our scheme were sketched in an earlier, unrelated INSEAD Knowledge article and podcast episode. Since then, we’ve crunched the actual numbers to prove conclusively that our rendition of UBI can work in the US without net damage to the economy.

Illustrating UBI and our proposed tax system revision

We assume that the core of the UBI would be a guaranteed tax-free monthly income for every adult citizen regardless of need or employability. There is a case for including children living at home, although not at the adult income level. Everyone over the age of 18 would receive a monthly “social dividend” of US$900, or US$10,800 p.a. (proportionately less for children). The payment for children would start at the age of 1 and increase gradually with age. For a household of four, with two young children, the monthly income could be set at US$27,000, just above the US federal poverty level (FPL) of US$26,200. In other words, UBI would be set to eliminate poverty outright. According to the Census Bureau, there were 128.6 million households in the US in 2019, so the total cost of UBI at this level would be around US$3.5 trillion p.a. The UBI would eliminate some existing government costs for targeted welfare services that are based on income.

The first objective of the incoming Biden-Harris administration should be to reverse the two major (and unnecessary) tax cuts that did not significantly accelerate economic growth but did increase inequality. Reversing both the Reagan and Trump tax cuts would add roughly $2 trillion to annual federal tax revenues, apart from macro-economic adjustments. Clearly, the “bonus” from reverting to pre-Reagan personal and corporate income taxes would suffice to pay close to two-thirds of our projected UBI costs.

Further financing of UBI could come from implied reduction of subsidy and bureaucracy costs of welfare provision at national and subnational levels. For the Netherlands, calculations indicate that these savings could amount to as much as 30 percent of the UBI cost. We conservatively assume these savings to be smaller in the US, at around $0.25 trillion p.a. This means the “unpaid” remainder of the UBI – the US$1.25 trillion not covered by reversing the two tax cuts mentioned above – must be paid for by additional tax revenues.

We propose to supplement the revised corporate profits tax (which now produces only 6 percent of US federal tax revenue) by a value added tax (VAT) on all private-sector service enterprises. These amount to 83 percent of the total GDP. Considering that the total GDP was US$21 trillion in 2019, it means a taxable base of around US$17 billion or so. A VAT of 5 percent on that service sector base would yield around US$0.85 trillion. Applied towards paying for UBI, it would leave a gap of about US$0.4 trillion. This gap could be filled by a tax on the sectors producing material goods (17 percent of the economy). These include agriculture, mining, forest products, fossil fuels (coal, petroleum, natural gas), construction and manufactured products. Those sectors generated US$3.6 trillion of GDP in 2019.

These resource taxes would be paid by primary producers and importers of hydrocarbons and products with ‘embodied’ carbon (like paper, plastics or Portland cement). We also argue for taxes on the consumption (net of recycling) of “virgin” scarce metals, such as cobalt, gallium, indium, tellurium, the platinum group, “rare earths” and other important electronic alloying elements. Adding US$0.4 trillion in environmental resource taxes – probably mostly on carbon emissions – would increase the costs of primary products (goods) by only 10 percent – surely tolerable – and would add only 3 percent or so to overall price levels.

The last part of this UBI package could be an electromagnetic frequency spectrum tax. Use of this EM spectrum needs to be allocated fairly by charging realistic prices. This tax could be collected partly in the form of television access fees – already common in Europe – and fees on Internet usage paid by advertisers and mass marketers. Sending email should also have a cost (like postage on first-class letters). Frivolous marketing use of the Internet, such as through junk mail – much of it fraudulent – would be discouraged by this tax. Even “big data” users might benefit, as the tax would reduce congestion on the Internet.

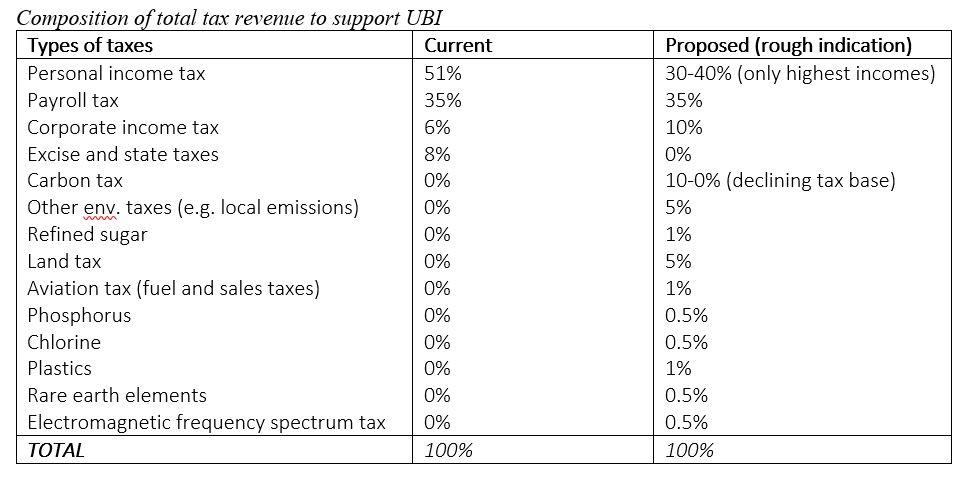

The table below summarises the shift in tax sources to support a UBI programme.

Gradual phase-in

The crucial point of the above proposal is that the benefits and associated costs should be introduced together, as a package. Otherwise, special interests will defeat it piece by piece. The introduction of the UBI package could be gradual, starting with a low level of basic income that slowly increases to its definite final value over 5 to 10 years. Parallel to this, the tax system could change gradually, with carbon taxes starting low and increasing to their maximum value. This would give the economy, notably the businesses and households needing to make long-term decisions and investments, time to anticipate and adapt with minimal transitional friction and costs.

*Emeritus Professor of Economics and Political Science and Technology Management at INSEAD, the Novartis Chair in Management and the Environment, Emeritus, author or co-author of 24 books& many journal articles and ICREA Research Professor at Universitat Autonoma de Barcelona, a Distinguished Professor of Environmental& Resource Economics at Vrije Universiteit Amsterdam

**first published in: knowledge.insead.edu

By: N. Peter Kramer

By: N. Peter Kramer