by Ahmed Galal Ismail*

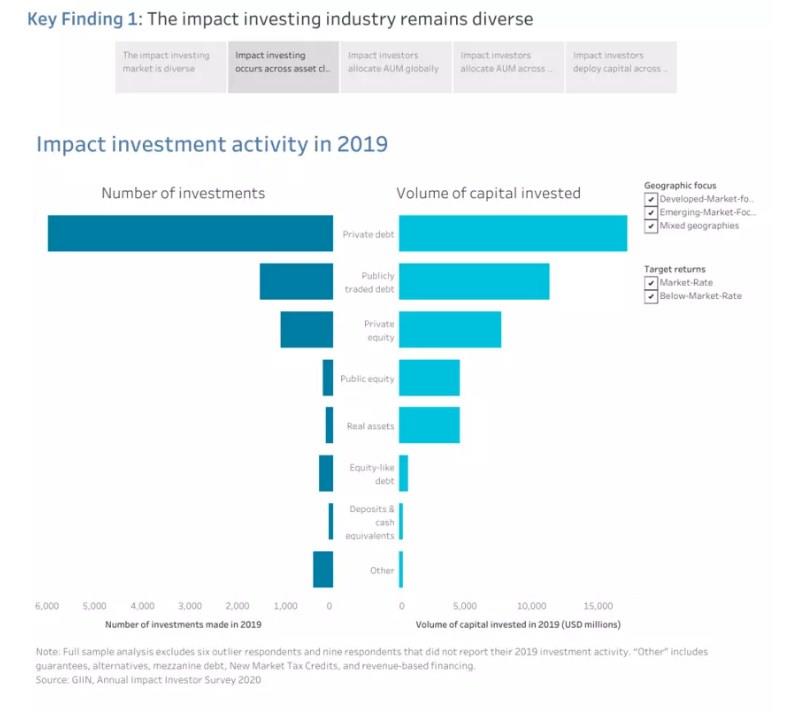

In 2019, impact investing was a $715 billion global market. Looking beyond the pure financial heft of the market, the number accurately reflects the growing reality among corporates and investors who are seeking to deliver strong financial returns for their shareholders, while building a more equitable world for their stakeholders.

With a sharper corporate focus on achieving Environmental, Social and Governance (ESG) impact, the appetite for investments that address some of the world’s most pressing challenges has grown steadily in recent years. In seeking to address these challenges, business has an historic opportunity.

It cannot abdicate its responsibility in working for a more just and progressive society for one fundamental reason: such an environment is a prerequisite for a sustainable, resilient and market-oriented private sector.

Historically, investments in sustainability have always been regarded through a narrow return-on-investment lens – an approach that could be even more challenging in the current context. However, that thinking has evolved over the years as global investors, pension funds, and financial institutions are demanding that their investee companies incorporate, track and report ESG performance into the risk-adjusted returns that they deliver.

What is more, there is growing evidence that by focusing on ‘people, prosperity and the planet’, businesses can generate long-term business value. This could be achieved by strengthening health and safety measures in hospitality assets to ensure guest well-being and drive greater footfall; by saving energy costs and reducing carbon emissions; or by making property assets more liveable with the help of digitalization and automation, ultimately enhancing the underlying value of these assets.

The list goes on and the arguments are compelling. For real estate affordability, liveability and resilience, investing in ESG is a ‘trade-on’ – not a ‘trade-off’.

ESG and value creation

Enterprises large and small have one dominant goal for 2020: economic survival. Beyond just ‘making it’ and getting through the year, businesses must also plan for the long-term to get back onto a growth curve. However, the choice between ‘survival’ and ‘survival with more costs’ is challenging.

A report by real-estate expert Knight Frank in 2019 underlined that there is strong evidence that investors are increasingly looking to deploy capital into energy-efficient, sustainable buildings. While implementing new, often complex, technology requires upfront investments, these are more than offset by higher rental incomes and lower operating costs.

Majid Al Futtaim’s hotel portfolio in the UAE is a case in point: together with Siemens and facilities management firm Enova (a joint venture between Veolia and Majid Al Futtaim) we embarked on introducing energy conservation measures across 13 hotels. While the cost of AED22.5 million is significant, the measures will lead to guaranteed annual savings of AED5.5 million – with a payback period of just over four years.

With utilities representing one of the largest operational costs for real estate assets, this increased efficiency will have a direct financial impact over the long-term. Moreover, assets with recognized sustainability credentials such as LEED, command a favourable premium as this serves as reassurance to both investors and tenants, thereby lowering the perceived risk of their commitment to the asset.

Our experience has taken us from regarding ESG as a lever to reduce risk and liabilities to embracing it as an opportunity to increase business performance and strengthen valuations across the lifecycle of our assets.

A market for ‘green’

While the risks associated with sustainability and other ESG-related investments have been a considerable barrier in the past, the ‘business of sustainability’ is now truly coming of age.

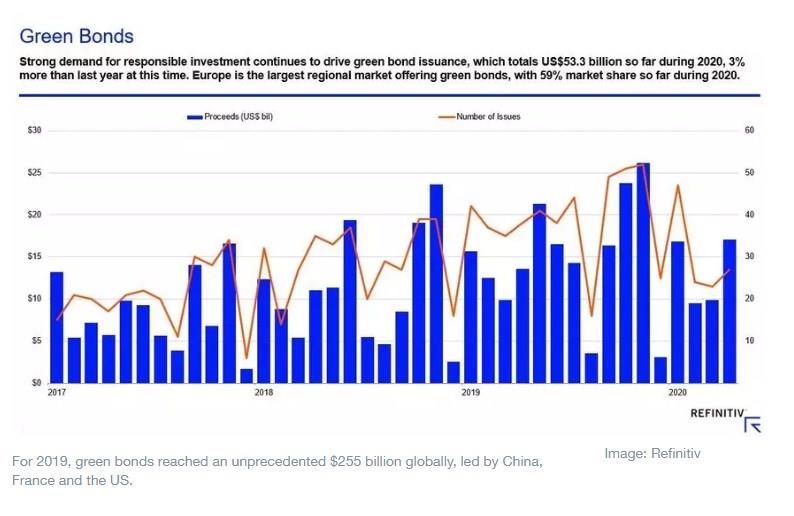

This is apparent when we look at the shift in the financial industry toward green bonds and similar vehicles for funding ESG-related investments. For 2019, green bonds reached an unprecedented $255 billion globally, led by China, France and the US. The new President of the European Central Bank (ECB), Christine Lagarde, has stressed her commitment to combatting climate change and examining green changes to the ECB’s activities, including its €2.8 trillion asset purchase scheme.

Closer to home, when Majid Al Futtaim launched its Green Sukuk (bond) in 2019 valued at $600 million, it was oversubscribed more than six times, with an order book above $3 billion. The first corporate Green Sukuk in the Middle East, the investments will be used towards Majid Al Futtaim’s long-standing 2040 Net Positive targets that align with our objectives of creating a more sustainable future for our stakeholders and generating strong returns for our partners.

The recovery from the pandemic has been called the ‘Great Reset’ by Professor Klaus Schwab and calls have been made to ‘build back better’. Strategic investments in ESG must represent a fundamental tenet of this framework. In building this ‘reset’, a whole range of stakeholders from investors, corporates, governments, financial institutions and consumers must align to create an ecosystem through which we invest in a cleaner, greener future.

Today, there is a unique opportunity for the property industry to lead the way when it comes to sustainable investments. But we also need the support of Governments and regulators to mandate and incentivize such investments to create meaningful opportunities for the industry and the multiple stakeholders it serves.

This will require hard dollars and soft power. But by working together and seizing the opportunities that are ahead, we can not only create a more sustainable future, but also unlock significant long-term value, for business and for society.

*Chief Executive Officer, Majid Al Futtaim – Properties

**first published in: www.weforum.org

By: N. Peter Kramer

By: N. Peter Kramer