Global business travel has largely ground to a halt during the pandemic. Experts have been raising the alarm that this is the death of business travel as we know it, arguing that it will be a long time before the virus is really gone and that business people have become used to meetings on the likes of Zoom and MS Teams. As a result, many of them no longer see the need for constantly crossing the globe and living out of a suitcase.

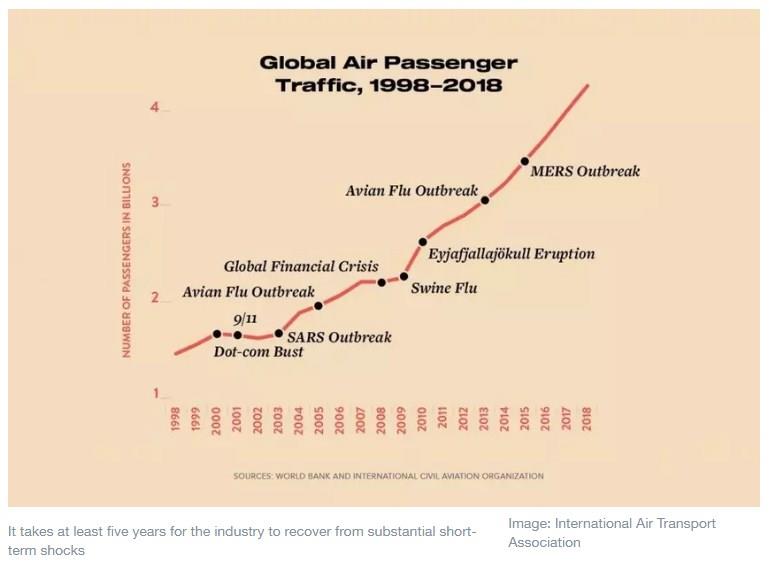

We want to urge caution here. There have been similar predictions before, and they were proven wrong. The 9/11 attacks had a negative effect on global business travel, for example, but it found its feet several years later. There was a similar downturn and revival in business travel after the global financial crisis of 2007-09.

In 2015, the International Air Transport Association found that it takes at least five years for the industry to recover from substantial short-term shocks. But despite those bumps, global airline traffic has shown stable long-term growth since the 1970s. Clearly, the longer the pandemic lasts, the longer the recovery may be, but it will probably come.

Our research

A revival in global business travel is likely to vary across sectors and the required location of travel. One sector that is centre stage right now, and arguably more insulated from the pandemic than others, is life sciences.

Medical device companies such as Medtronic and Roche have been benefiting by selling equipment to help fight the virus, such as ventilators and testing kits. Pharmaceutical companies such as AstraZeneca and Pfizer are banking on producing a vaccine before 2021.

So this is an industry that has stayed active during the crisis and is likely to be a big winner over the next couple of years. It is also a sector that engages its employees in substantial business travel around the world. For these reasons, it is arguably the ideal sector in which to carry out research into the future of business travel.

We interviewed 15 global managers in major medical devices firms, before and during the pandemic, to explore the importance of business travel in carrying out their global work. They resoundingly agreed that although their travel schedules are for the most part on hiatus, they expect to be back in the air as soon as they can.

At least in the short term, however, they expect global travel to proceed differently for them. Their companies will focus on sending executives to countries that are part of regional travel corridors where flights are permitted and there are not quarantine requirements at either end.

Our interviewees report that some firms have already increased their travel in cars or trains where convenient, particularly in Europe. Intercontinental business travel is expected to be the slowest to return, with North and South America likely to be the last continents to open up again. Companies we talked to have planned their first face-to-face global gatherings for October 2020, based within their home region.

In parallel, the travel industry is keen to remove restrictions and open up travel routes, particularly within and between Europe, the Middle East and east Asia. We are also witnessing a rise in the use of individuals and organisations hiring private jets as short-term solutions to avoiding airport delays. Some UK universities have also pursued this route, chartering private jets for incoming international students as a way to ensure a steady flow of income.

Years to come

In the medium term, our study suggests that life sciences companies will continue to expand, particularly in developing countries, and view travel as a vital channel for maintaining existing and securing new business in these markets.

Our interviewees insist that doing business in developing markets requires overcoming complex cultural issues, and that you build up trust by meeting face to face. Sealing a deal with a new customer, training a local physician on a new product, or solving a problem in a global team can only be done in person.

Our research, therefore, makes us sceptical that global firms will replace travel with virtual substitutes over the longer term. The companies of our interviewees have been relatively slow to adjust to virtual meetings. So far, managers have received little training on global remote working or building virtual skills, and commonly have been left to their own devices.

We found that global remote working was not the escape from the intense conditions of business travel that you might think. Managers found that it still meant extended workdays in order to connect across time zones. They were generally bored of Zoom meetings and eager to get back in the air, despite the intensive lifestyle it creates and work-family conflicts. It appears that global travel is ingrained in the culture of their companies, and will remain part of these managers’ DNA.

Having said all that, our research also raises significant concerns over how these companies are managing the wellbeing of their business travellers. Our findings corroborate recent work by the International SOS Foundation revealing that frequent business trips lead to physical and mental challenges ranging from stress and depression to poor sleep and a bad diet.

Worryingly, most company wellbeing initiatives related to flexible working, mental health, or training and development do not account for the trials that frequent fliers face. And as business travel returns after the pandemic, it is likely to be more stressful than before. Despite the desire to return to the way things were, the world may look quite different and may add further, unanticipated pressure points.

This evidence may be an early indicator of where other industries might get to after the pandemic has ended. Above all, the much discussed “new normal” may apply less to business travel than many believe.

*first published in: www.weforum.org