by Jean-Baptiste Wautier and Justin Jensen*

As we move through the COVID-19 pandemic, the importance of active ownership to accelerate the public market shift to “stakeholder capitalism” is becoming even more clear – particularly as inequalities are exacerbated and both investors and companies look to do the right thing for their partners and shareholders, as well as for society at large.

However, the concept of active ownership has been building momentum as a topic of keen interest within the investment community for several years. Higher demand from clients, who increasingly expect managers to not only identify promising investments but also aid in creating long-term value, has served as a strong motivator for investment managers across all asset classes to look for ways to increase and improve their engagement with portfolio companies.

This has been coupled with more stringent regulatory codes (such as the recently updated UK Stewardship code), and an already increasing emphasis on stakeholder capitalism, as evidenced by BlackRock CEO Larry Fink’s annual letter to CEOs. This challenge is particularly acute in public equity markets, where excessive focus on quarterly performance rather than long-term measures of success may contribute to short-termism.

Meanwhile, private market investors, such as private equity (PE) firms, have long had an upper hand when it comes to active ownership. Many of the tactics used by these firms can provide insights to public market investors who are looking to improve the efficiency of their stewardship practices. This article predominantly looks at the private equity model as a useful example of private market stewardship techniques.

Private market investors, such as PE firms, enjoy a structural advantage that public market investors do not benefit from

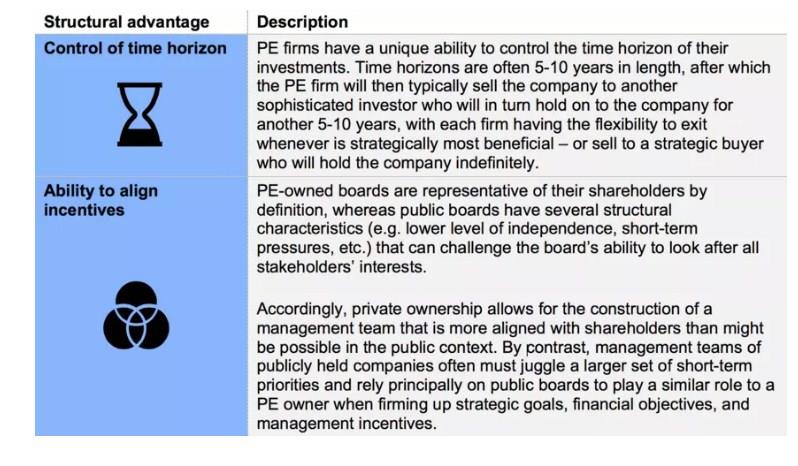

In order to draw further insights, one must first acknowledge the structural advantages private investors such as PE firms have historically enjoyed:

The ability to control the time horizon goes hand-in-hand with reduced reporting requirements and share price pressure. However, the most significant benefit comes from the increased focus on long-term strategy. When thinking on a 5-10-year time horizon, building lasting strategic value becomes a necessity. Therefore, PE firms have high incentives to factor in a comprehensive set of long-term stakeholder impacts and environmental, social and governance (ESG) matters. In essence, the need to maintain an attractive business up to the firm’s exit can reinforce positive action such as embracing long-term, sustainable energy over fossil fuels.

PE firms have also historically benefitted from information asymmetries in a way that public market investors have not – though this advantage is muted in comparison to the control of time horizon and incentive alignment. Principally, PE firms may have access to key information that is not public, whether on a particular sector, technological element, or a combination of items.

This advantage has dwindled in recent years due to overall trends around information and transparency, as well as regulations such as the SEC’s Regulation Fair Disclosure, which means any information a company releases to a select group must be released publicly. Today, PE firms more often rely on hands-on, active ownership – transforming assets, being efficient operators, increasing strategic value, and capitalizing on growth potential. In fact, PE firms have in turn borrowed from the playbook of certain large public companies to gain best in class operating measures, which they have combined with the proper long-term incentives and the ability to time entry and exit, in order to ensure optimal value creation.

Private equity firms create a culture shock within their acquired companies

When a PE firm acquires a company – either from the public markets, corporate owners, or founders – there are typically two positive culture shocks for both the management and their employees:

1. For formerly public companies, there is a sense of relief from the short-term pressures of share price considerations and quarterly reporting burdens.

2. For all companies, there is often an abrupt realization that a focus on value creation had either a) not been top of mind or b) been under-prioritized due to concerns around cash, short-term performance, internal politics, or other considerations.

In short, PE acquisitions allow companies to shift their focus to be solely on their long-term strategies. With this comes the ability to align the investor time horizon with the portfolio companies’ value creation horizon, which has been the key to PE firms’ success and provides the strongest insight into what public market investors should prioritize within their stewardship practices.

Lessons for public market investors

In observing the private equity model, applications to public market stewardship become readily apparent:

1. Amplify Board leadership

Given the trend towards increased information, public boards must be empowered to ensure the right governance and management incentives to ensure shareholders’ interests in the long term. Thus, boards must act in the same way as PE owners in prioritizing the right long-term goals over short-term quick wins, and influencing the purpose, culture, and long-term direction of the firm. FCLTGlobal has derived the following mechanisms for ensuring a high-function long-term board:

a) Ensure board composition is reflective of the future

b) Align rewards for board service with long-term value creation

c) Strengthen board understanding of long-term shareholder objectives

d) Reallocate time to activities that create long-term strategic value

e) Consider the pros and cons of delegating long-term or short-term issues to subcommittees

f) Focus on the long-term growth and development of board directors

2. Reassess strategic timeframe

Short-term information requirements such as quarterly or annual earnings reporting can, at times, lead to undue pressure to demonstrate short-term earnings or dividend payout expectations over long-term value creation. However, a trend toward increased information and transparency is clear and unlikely to change, particularly with the onset of AI for analyzing data and information. Thus, public companies, along with their investor base, should reassess their approach to short-term information requirements and lessen the burden of short-term reporting where feasible.

3. Acknowledge public-private asset class convergence

Select public investors (including some activists) are borrowing from the PE approach to strategy, value creation, and management incentives and applying it to their public holdings – leading to a convergence of public and private asset class management. As this trend continues, there will be opportunities for public market investors to launch long-term private market strategies in parallel to their public platforms. For example, BlackRock has recently launched a private strategy in an effort to cater to long-term investors. Meanwhile, a number of leading private equity firms such as Blackstone Group, Carlyle Group, KKR, and CVC Capital Partners have announced longer-dated funds that will own companies for up to 15 years or more.

*Partner, Chairman of the Investment Committee, Member of the Executive Committee, BC Partners and Project manager, World Economic Forum

**first published in: www.weforum.org

By: N. Peter Kramer

By: N. Peter Kramer