by Theo Vermaelen*

Experts have been forecasting terrible economic consequences of the coronavirus outbreak. Many compare it to 1929 or 2008, years that were associated with major stock market collapses followed by deep recessions. The truth is, none of us has a crystal ball. But from my perspective, I see at least as many signs pointing to a less severe stock market downturn, if not a fairly rapid recovery.

What makes a bear market

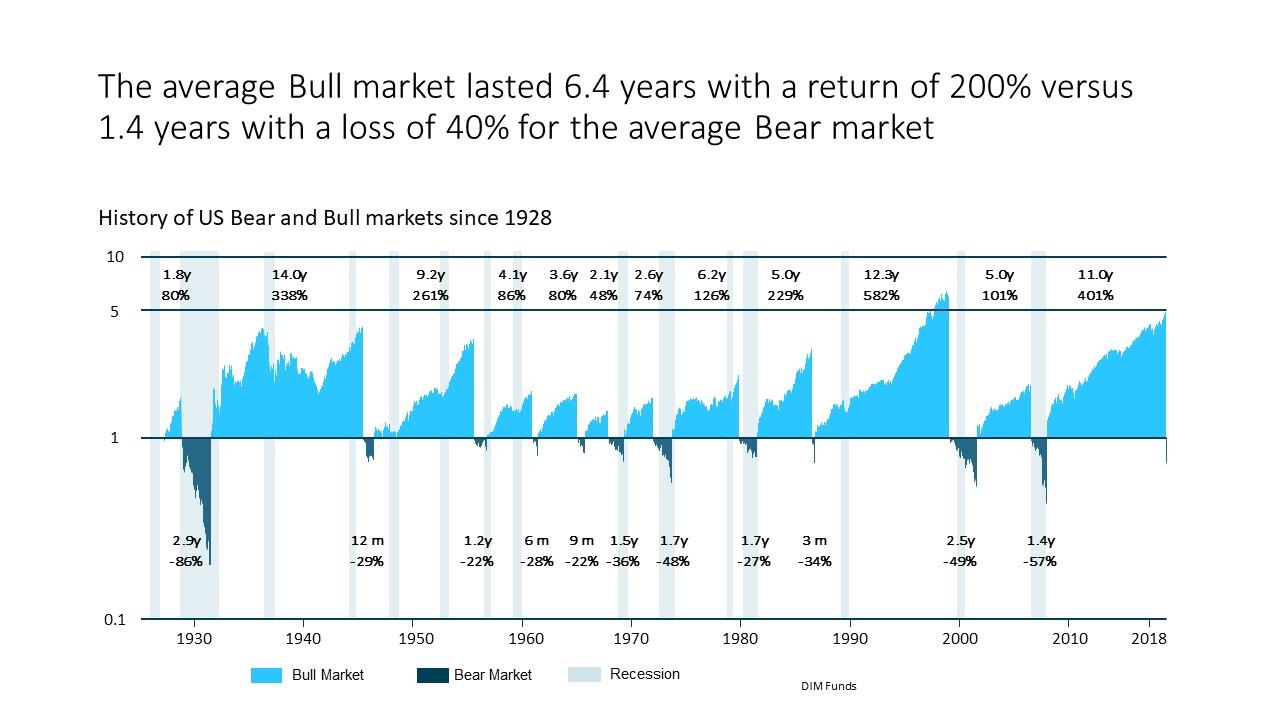

The following chart shows the calculation of bull and bear markets since 1928. A bear market is defined as a period during which stocks fall more than 20 percent of their previous high. A bull market is defined as a market where stocks increase by more than 20 percent from their previous low.

Note that bear markets tend to be short (1.4 years) while bull markets tend to be long (6.4 years), which is not surprising as stock prices are expected to go up. The worst collapse occurred during the Great Depression, followed by two major bear markets that started in 2001 and 2008, with stock price declines of more than 50 percent. Both bear markets from this century were associated with collapses in asset prices: technology stocks in 2001 and housing prices in 2008.

Why is the current crisis not comparable?

First, the fall in stock prices is not the result of the collapse of an asset bubble. It is due to the interruption of economic activity to fight a disease. In contrast to 2001 and 2008, there is no reason to assume that asset prices and economic activity will not revert to their previous levels. This reversion could come soon, depending on how long it takes to manage the disease. Pharmaceutical companies are in a race to develop a cure and a vaccine. We can expect that the profit motive will be a force for good. One hopeful development is the announcement in mid-April that Gilead Sciences may have discovered a cure.

Second, while the S&P 500 dropped 30 percent between 1 January and 24 March, just a few weeks later (17 April) the loss is now only 10 percent, making it possibly the shortest bear market in history. Of course, markets could be wrong, but I believe there is an increased understanding that the value of a company is measured by the present value of expected cash flows from now until infinity. In this framework, bad short-term economic performance should have a small effect on stock prices. Only those investors who use short-term profits to value firms, e.g. using earnings multiples, will predict a major collapse. Lenders should also take a long-term view when they face borrowers in financial distress because of a lack of working capital. The assumption that this will be a short-term problem explains why markets continue to shrug off the spectacularly high unemployment numbers. Indeed, what does it mean to be unemployed when governments lock down consumers and prevent people from going to work?

Third, in 2008 “evil” bankers were blamed for the financial crisis and they had to be punished. Hence Lehman Brothers was not bailed out, which created a panic on Wall Street. Today, corporations are not in the firing line and governments have responded by helping firms to deal with their short-term cash flow shortages. Voters haven’t expressed any outrage at bailing out the private sector, in contrast to 2008. Various initiatives from the US government include the Federal Reserve lowering interest rates to zero, starting a US$700 billion open-ended quantitative easing programme and lowering capital requirements for banks, as well as President Donald Trump’s initiative to launch an unprecedented US$2 trillion COVID-19 rescue programme and reopen the US economy.

Fourth, in March 2020, we observed the largest number of share buyback authorisation announcements in ten years, which is usually a sign that investors believe markets have overreacted to bad news. Although we have witnessed the suspension of some buyback programmes, this doesn’t necessarily mean firms believe they are no longer undervalued: Firms may suspend their buyback programme because they want to preserve working capital or because Trump has made subsidies conditional on stopping buybacks. They may also believe the panic will create great opportunities to acquire undervalued competitors. Another factor consistent with the belief that the current collapse is overdone is March 2020 had the largest ratio of net insider buying to selling since 2008.

So, the hopeful signals we get from the market should be reassuring to all. We should not get carried away in a self-fulfilling death spiral fuelled by pessimism. When economies start to reopen, we should support the businesses that suffered most: Go to a restaurant, plan a trip and, above all, get a haircut!

*Professor of Finance at INSEAD and the UBS Chair in Investment Banking, endowed in honour of Henry Grunfeld and chair of the Finance academic area and programme director of Advanced International Corporate Finance

**first published in: knowledge.insead.edu

By: N. Peter Kramer

By: N. Peter Kramer