by Amit Bhattacharjee*

As the global coronavirus case count rises by the tens of thousands a day, the number of people in need of financial help may be following an even steeper exponential curve. In the United States alone, a staggering 17 million people registered for unemployment benefits in just three weeks, shortly after economic activity in the country screeched to a halt. Billionaire corporate titans, celebrities and athletes are digging into their deep pockets in response: From Bill Gates, Carlos Slim and Jack Ma to Rihanna and Roger Federer, the rich and famous are donating cash or supplies to the less fortunate. You might also be wondering what you can do to help.

Or whether you should, given your comparatively modest means. After all, with businesses shuttered en masse and job security growing more precarious with every passing day, you might be among the countless individuals anxiously bracing for a financial hit. My research on the psychology of charitable giving might help you answer that question by highlighting a widespread bias that discourages even the objectively well-off from giving to charity.

In our paper “Passing the buck to the wealthier: Reference-dependent standards of generosity”, my co-authors Jonathan Berman, Deborah Small, Gal Zauberman and I show that irrespective of income levels, people expect those who earn more than they do to give much more to charity than those higher earners believe they ought to give. Although people expect higher-earning others to feel flush with spare money, those higher-earners actually report feeling similarly constrained. They in turn mistakenly expect even higher-earners to feel flush, and this pattern continues up the income spectrum. As a result, even wealthy individuals tend to feel justified in donating very little in the present. These subjective feelings of financial constraint diminish charitable giving even in the best of times, let alone in the midst of a global pandemic.

Objectively rich, subjectively poor

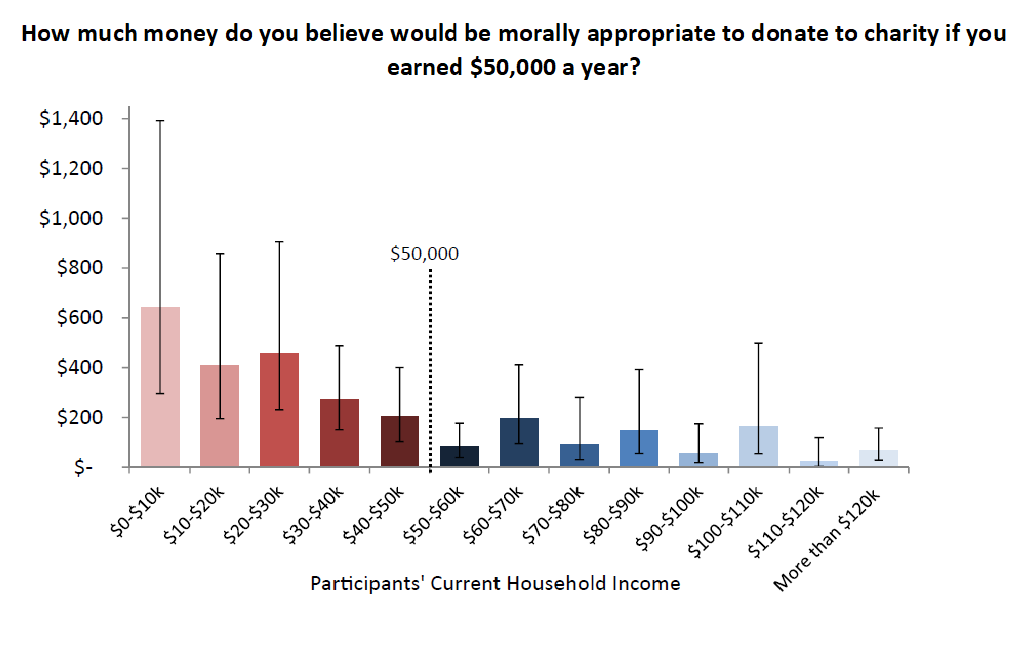

That human beings compare themselves with others to make sense of their circumstances is a well-documented tendency. In this context, we sought to investigate how individuals assign charitable obligations to themselves and others through four studies and a meta-analysis. In the first study, we asked 505 participants (median household income = US$45,000) how much they thought would be appropriate to donate to charity if their household income was US$50,000 a year. We also asked how well they would be able to weather an unexpected one-time expense of US$2,000 – a measure of how much spare cash participants expected to have if they were making US$50,000.

The second experiment was almost identical to the first, except that the 1,002 participants were asked what someone similar to themselves should give to charity. For example, a 36-year-old male participant who reported being single and childless was asked to imagine a male target with the same characteristics.

From the first two studies, we found that the less participants earned relative to US$50,000, the more spare money they expected themselves (or the imagined other) to have available if they earned this amount. Consequently, the more they believed they (or the imagined other) should be obliged to donate to charity.

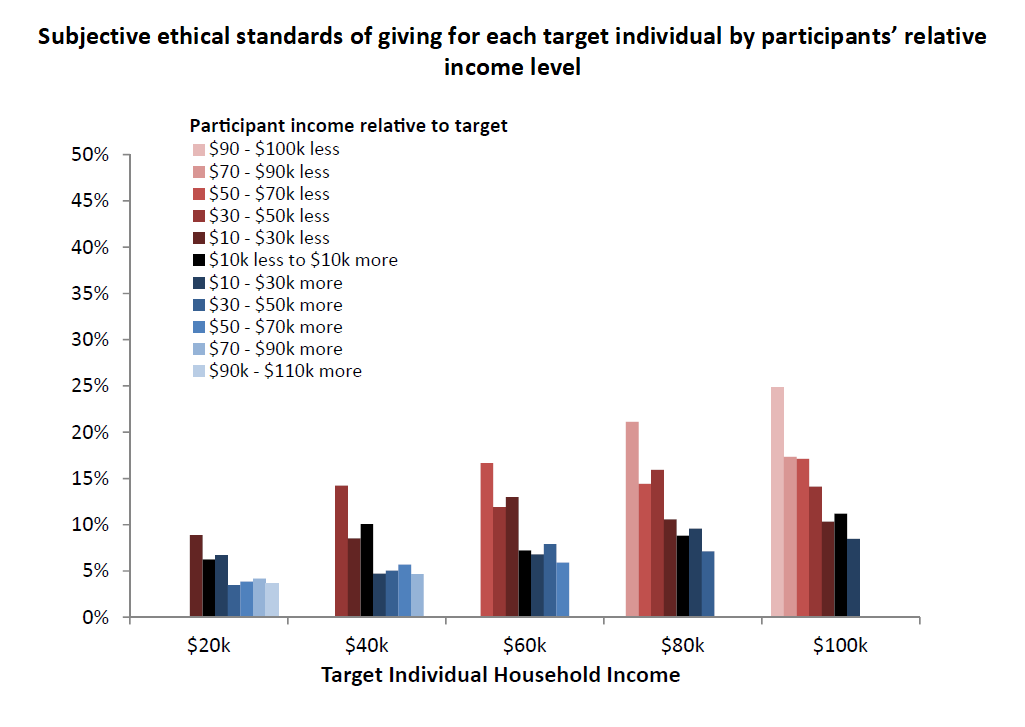

Our third study examined a range of target incomes. Participants were recruited from various income brackets, from US$0-10,000 to more than US$110,000. Each of them was presented with five target individuals with different incomes – US$20,000, US$40,000, US$60,000, US$80,000 or US$100,000 – and asked what percentage of household income that individual should donate to charity each year.

Just like in the first two experiments, the results revealed a negative relationship between relative income level and subjective giving standards: The less participants earned relative to a target, the more they believed that target should donate to charity. Conversely, the more participants earned relative to a target, the less they believed that target should donate. Across all the income levels we assessed, individuals believed that they themselves, as well as lower earners, should largely be excused from obligations to donate to charity. At the same time, they felt that anyone earning more than them was obligated to donate significantly more than those higher earners themselves felt they should. The robustness of these findings was confirmed by a meta-analysis of all 15 studies we ran (including those not fully reported in the paper).

Our results also indicate that any gains in perceptions of spare money may be short-lived. Once people do earn more money, they quickly tend to increase their discretionary spending, again find themselves strapped for cash, and thus put off donating until they earn even more. In other words, they consistently “pass the buck” to wealthier others or to their future, wealthier selves.

Coincidentally, our findings were echoed by a 2019 survey of 400 multimillionaires in nine economies by Barclays bank: 75 percent of these multimillionaires believed that philanthropy was the responsibility of even richer folks. Similarly, other surveys have shown that many objectively rich people do not even consider themselves to be wealthy or financially secure.

The buck should stop here

Although not all of us can claim to have millions in the bank, the average INSEAD Knowledge reader is likely to be well above average financially. An individual earning $50,000 post-tax in the US, for instance, ranks within the top 1.5 percent of income-earners worldwide, even after accounting for differences in purchasing power.

The coronavirus pandemic has only brought the gulf between the haves and the have-nots of the world into sharper relief. In developed countries, lockdowns have sent people rushing to supermarkets in a panic-buying frenzy, and anxiety due to remote working and business shutdowns is rampant. Meanwhile, in countries like India and Brazil, millions of daily-wage earners are staring at starvation as soon as shelter-in-place is enforced. Those who live in slums have nowhere to isolate themselves from loved ones at home. And while residents of the developed world now wash their hands as often as necessary to keep the virus at bay, many among the global poor don’t have access to running water. Even within countries, the have-nots are suffering disproportionately more from the impact of the pandemic, as the millions of Americans seeking government help can attest.

If there is never a good time to pass the charitable buck to others, the unprecedented crisis currently afflicting countries rich and poor might be the worst time to shrug off that responsibility. Should the coronavirus devastate developing economies in Africa, Asia and South America, the developed world will be haunted by the economic repercussions long after this health emergency has passed. Headline-grabbing calamities like COVID-19 provide us with an opportunity to consider those we habitually neglect to help: the countless masses still affected by persistent societal problems like poverty, war and curable disease, which attract less attention but also cause widespread human misery on an ongoing basis.

There are few established standards of charitable giving outside of religious communities. And of course, few can match the charitable largesse of the rich and famous. Still, most of us fail to acknowledge our own capacity to give something to the poor, the jobless and the war-ravaged and displaced, even as we hunker down for this crisis and those to come.

*Associate Professor of Marketing at INSEAD

**first published in: knowledge.insead.edu

By: N. Peter Kramer

By: N. Peter Kramer