by Fred Krupp*

With the US administration turning its back on the Paris Climate Agreement, demands for corporate climate leadership are mounting. At a time when executives should be filling the leadership gap, too many CEOs continue to be trapped by short-term, profit-only thinking.

Positive return on investment (ROI) is one sign of a healthy business. But equating ROI with profits alone is dangerously outdated thinking. For business leaders, especially those based in the US, the stakes have changed and the pressure is on - from consumers, employees and shareholders alike - to build a broader understanding of ROI into your business models.

A recent Environmental Defense Fund study of 600 executives at companies with $500 million or more in earnings shows that the belief in balancing profits with environmental stewardship is strong. Stakeholder pressure is substantial. The technologies are readily available. But so far the investments are not. Many business leaders have a gap to fill between their talk and their walk.

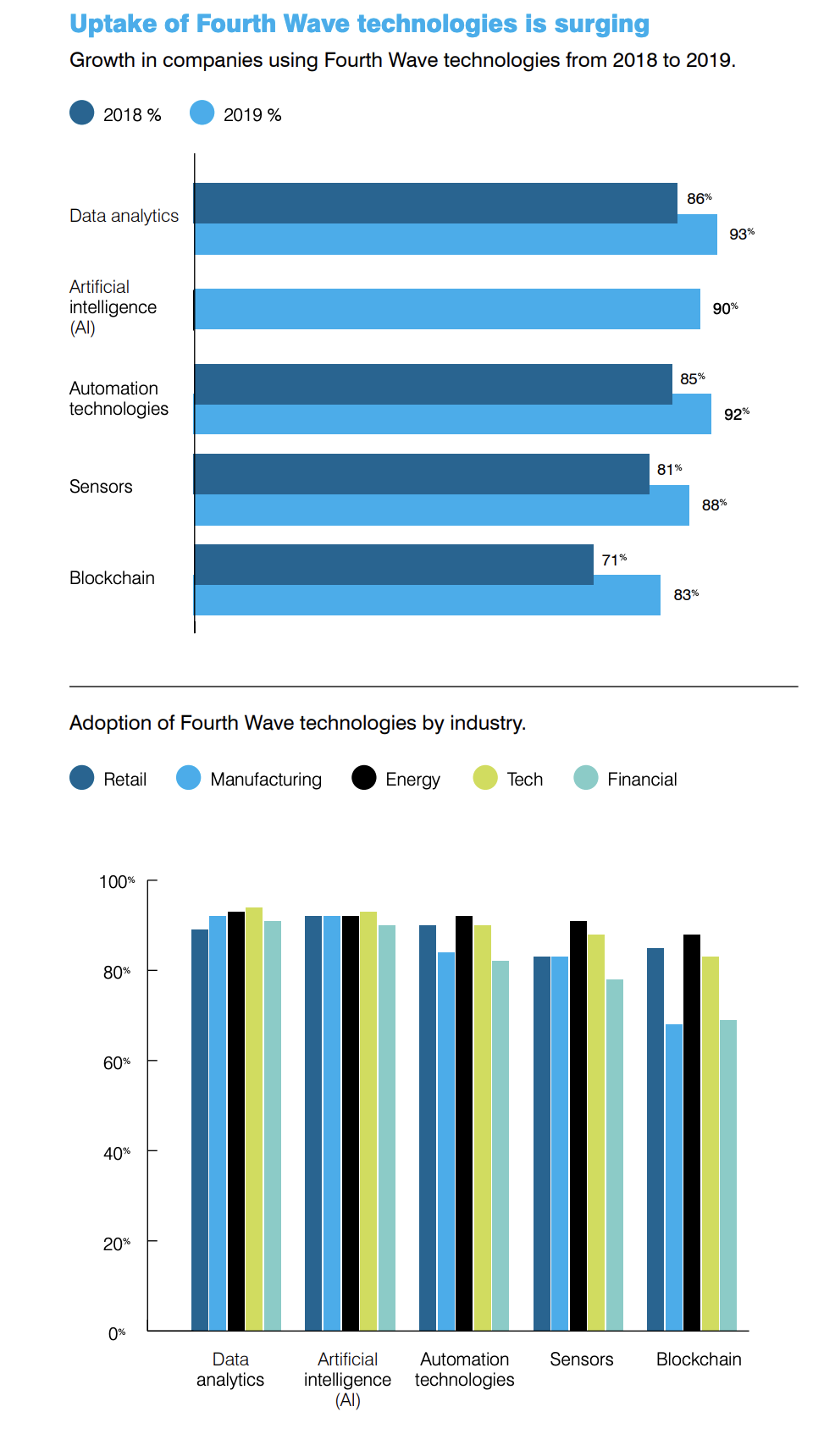

When looking at five specific technologies – data analytics, sensors, artificial intelligence (AI), automation and blockchain – uptake across all sectors has increased year over year, with 94% of business leaders saying they are putting these technologies to work in order to stay competitive (we’re not talking about research and development here, but the deployment of newly available innovations). Yet despite overwhelming agreement that this tech can boost both ROI and sustainability, only 59% of leaders say they are actually investing in tech for sustainability.

First, congratulations to the almost two-thirds of executives who are stepping up. Over time, your businesses will enjoy a tremendous advantage over those who do not. Second, for the 33% who understand the need to invest in environmental innovation, yet aren’t doing so: we need to talk. The gap between belief and investment represents a critical opportunity for companies to double-down on sustainability commitments and lead on climate — as your consumers, employees and investors all expect.

Before we dig deeper, let’s acknowledge that businesses have made real strides on sustainability in recent years. We’re seeing an uptick in corporate commitments to major emissions reductions, procuring expanding renewable portfolios, and even engagement on climate policy. However, an important opportunity is being missed. A new wave of technological innovation can drive both bottom-line and environmental gains, but some business leaders are not yet making the connection.

So why aren’t more business leaders investing in the rapid deployment of technology to make their companies more sustainable? Two alarming hindrances were noted: lack of clear ROI and lack of quick ROI, both of which sound a lot like old-school, quarterly returns-focused leadership.

The CEOs who are investing understand that corporate sustainability is an essential strategy not only for addressing the climate crisis, but also for ensuring long-term business competitiveness. Two key factors have moved them to act.

First, pervasive pressure from stakeholders. Consumers are top influencers, with over half the respondents in a 2019 retail study saying that sustainable business practices drive brand loyalty. Employees are using their volume, networks and stock options to leverage change within their companies, as seen recently with Google, Amazon and others. And the perception that investors don’t care about environmental, social and corporate governance (ESG) is just outdated. Sustainable investing is becoming synonymous with investing, according to a study in the Harvard Business Review. Investors are seeking deeper levels of engagement with their portfolio companies, especially around ESG issues that affect financial performance.

Second, many businesses are already finding a fruitful balance between profits and the planet by capitalizing on the win-win that today’s technology can deliver. Amazon is addressing fleet emissions and freight expense by purchasing 100,000 electric trucks, a move also made, albeit at a smaller scale, by IKEA. AT&T is mitigating operational risks from climate change by using supercomputers to model extreme weather. And Walmart, which with partner IBM used blockchain to trace food safety and contain recalls, recently announced that it is piloting a system that uses blockchain to track shrimp supply chains.

New industries are springing up to help the business world be more sustainable. From a company that uses sensors and coatings to create smart windows capable of increasing a building’s energy efficiency by 20%, to robotics and AI for factory automation, to a business driving down the cost of meters for microgrid energy – sustainability innovations are driving a new renaissance for tech. And the market is growing. Investments into sustainable technologies surged to over $9 billion last year, a 127% jump from 2017.

At a time when stakeholders are pressuring leaders to raise the bar on corporate climate leadership, executives cannot hide behind outdated notions of ROI. The same technology that is helping them compete financially can help drive a better future for the planet as well. It’s time for all business leaders to actively invest in environmental innovation. The future of your company—and the planet— depends on it.

*President, Environmental Defense Fund

**first published in: www.weforum.org

By: N. Peter Kramer

By: N. Peter Kramer