by

Francine Giskes*

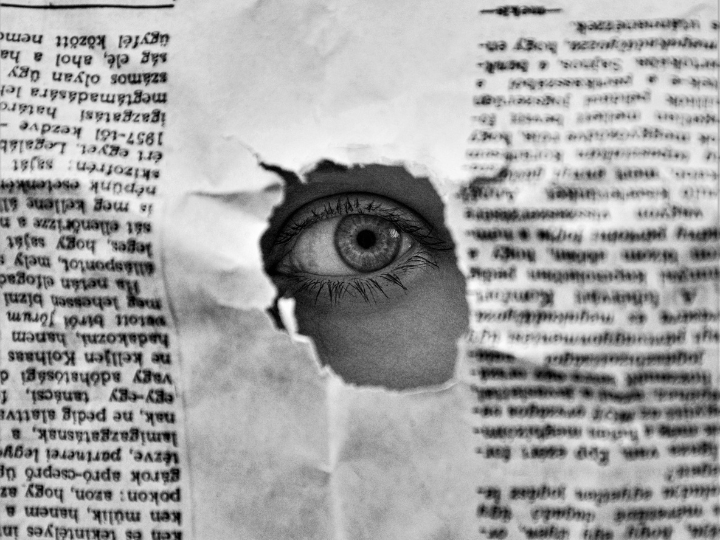

With web-based international sales of goods and services now growing at an explosive rate, is the EU doing enough to keep track of VAT payments? The Netherlands Court of Audit is currently performing a joint audit with its sister organisations, to find out how the European tax authorities are tackling this problem. And it’s a vital issue, given the huge amounts of money involved.

There’s plenty of debate in the international arena as to whether the internet giants are paying enough corporation tax. The problem is likely to be a regular agenda item at future EU summits. But this is not the only tax blaze sparked by the boundless growth of the digital economy. Another challenge is whether the tax authorities can find out whether traders supplying goods and services through on-line channels have declared and paid the appropriate VAT charge.

The internet has given a tremendous boost to the digitisation and internationalisation of economic transactions. The emergence of e-commerce, i.e. on-line sales of goods and services, has opened tremendous new opportunities for cross-border transactions.

One of the inherent characteristics of e-commerce is that it is not linked to a specific time or place, which makes it easier to keep transactions out of sight of the tax authorities. This may lead to unfair competition with traditional suppliers operating in the conventional economy, whom the tax authorities do have in their sights.

It’s high time to turn the spotlight on indirect taxes such as VAT. While the tax authorities may well be capable of tracking on-line transactions within their own domestic borders, it’s much harder for them to do the same with cross-border transactions. Indeed, the European Commission reckons that the authorities are currently missing out on €5 billion worth of VAT revenue each year because of these on-line transactions. This figure could rise to €7 billion by 2020.

There are all sorts of reasons why this VAT goes uncollected. Firstly, on-line transactions are much easier to conceal from the tax authorities than physical transactions are. Secondly, where digital services are involved, there is no exchange of goods that could provide a platform for a VAT charge. Thirdly, if a foreign supplier fails to register for VAT as required, the authorities may have a tough time trying to get hold of its ID information.

Fourthly, the sales figures quoted in VAT returns may be lower than the amounts actually paid by the supplier’s customers, or the description of the origin of the goods in question may be inaccurate. Finally, tax authorities need the support of treaties with other countries to be able to effectively investigate foreign suppliers of goods or services.

The massive scale of the fraud in the EU is illustrated by the success of the German tax authorities in December 2016, when they targeted Chinese companies trading through the Amazon platform. The authorities blocked the latter’s’ bank accounts and impounded goods sitting in Amazon warehouses. The Minister of Finance in the German federal state of Hessen claimed that such companies evaded ‘hundreds of millions of euros’ in VAT every year, based on expert estimates.

The explosive growth of e-commerce has led to the emergence of new VAT systems in the EU. One of them is the ‘Mini One-Stop Shopping’ (MOSS) scheme put in place in 2015 for companies supplying digital services to consumers. This scheme entitles companies to register for VAT in a single EU member state, instead of in every single country in which their customers are located. In December 2017, it was decided to extend the MOSS scheme to sales of goods as from 2021.

These new developments must be accompanied by a closer monitoring of tax compliance. In the wake of the massive increase in international e-commerce and the related risks in terms of the collection of VAT revenue, the tax authorities need to have effective tools for enforcing tax laws if they are to stem the flow of VAT losses. Past experience with anti-VAT fraud measures and the introduction of schemes such as MOSS shows that the controls can be watertight only if the tax authorities in the EU remain alert – and work closely together. Indeed, once the MOSS scheme is extended to supplies of goods, the need for cooperation will become even more pressing.

The situation prompted the Netherlands Court of Audit to join forces with a number of sister organisations in other EU countries in order to investigate whether the tax authorities make sure that traders submit timely, accurate and comprehensive VAT returns through the MOSS system, and also that they pay the full amount of VAT due. We are hoping to publish the findings of this audit in the second half of this year. In the meantime, it would be a good thing if, during international discussions on the tax implications of e-commerce, the question of the enforcement of VAT regulations were given the full attention it deserves.

*Francine Giskes is a member of the Board of The Netherlands Court of Audit

**First published in Financieele Dagblad, March 21, 2018

By: N. Peter Kramer

By: N. Peter Kramer