For the International Monetary Fund's chief economist, two big global trends jump off the page - the growing role of developing countries in the world economy and the ageing population of the developed world.

And Raghu Rajan said in an interview that the two trends could, and should be linked.

How? In short, because rich countries should be saving for their old age. They should invest more in the developing world where there are plenty of workers and a need for capital.

The income from that investment could then pay for the pensions and healthcare needed by ageing populations in rich nations.

Two-way street

Mr Rajan said capital should be transferred "to younger populations which will be able to use it more productively and pay a return which would be a good thing for the developed economies in their old age".

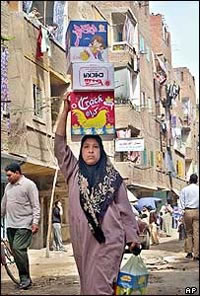

Another way the same benefits could be achieved is migration - workers from the developing world moving to rich countries.

He said: "Some mix of immigration and capital outflows will eventually be a way of solving, quote unquote, the ageing problem."

Mr Rajan said that developing countries already account for a growing share of global activity, just because they are growing faster than the rich countries. But he added: "They are typically more volatile, there are more ups and downs."

Problem or powerhouse?

He said: "One of the biggest concerns in the world economy nowadays is Chinese growth."

The impact of China will vary from country to country, but it "is something one wouldn't have thought of, any developing country being so central to the world economy in the past", he said

The volatility is one reason that savings don't go to the developing world in the quantities that Mr Rajan thinks they should.

He said developing country governments have not reformed their financial systems enough to make them attractive and safe for investors from rich countries.

US imbalance

But it's not just their fault. The rich countries, especially the United States, should be saving more.

The US is importing capital especially from Asia, when it should, he said, be sending more abroad.

American households need to save more. The government needs to reduce the deficit in its own finances and borrow less from abroad - so more would be available for investment in the developing world.

The IMF's new report on the World Economic Outlook does identify a source of savings that is providing more funds for investment in the developing world - money sent back home by migrant workers.

It amounts to about $100bn (£52bn; 77bn euros) a year, and for some developing countries half of total capital inflows.

Some of it is used for day-to-day spending, but a lot goes into investment in small businesses.

By: N. Peter Kramer

By: N. Peter Kramer